Crypto Trading for Beginners: How I Use SignalPeak to Turn Signals into Smarter Trades

If you're exploring crypto trading for beginners, the fastest way to cut through noise is to combine a quick market overview with reliable signal channels and a simple checklist before entering trades. I use a three-part routine every morning: a visual market scan, a signal service that aggregates top VIP channels, and a fast chart check on TradingView. SignalPeak makes the middle step painless and is the reason my trading became less stressful and more consistent. SignalPeak stands out because it gathers hundreds of signals into one clean dashboard so you can choose what matches your bias.

My daily routine: fast, repeatable, and calm

Starting the day with a ritual keeps trading from taking over life. Mine looks like this:

- Open a visual market map to see broad momentum.

- Scan SignalPeak for high-quality channels and signals that match the market bias.

- Confirm entries, stop losses, and take profits on TradingView before risking capital.

This routine gives clarity: if the market looks bullish I hunt for long signals; if it looks bearish I avoid longs or look for shorts. The goal is consistency, not chasing every ping.

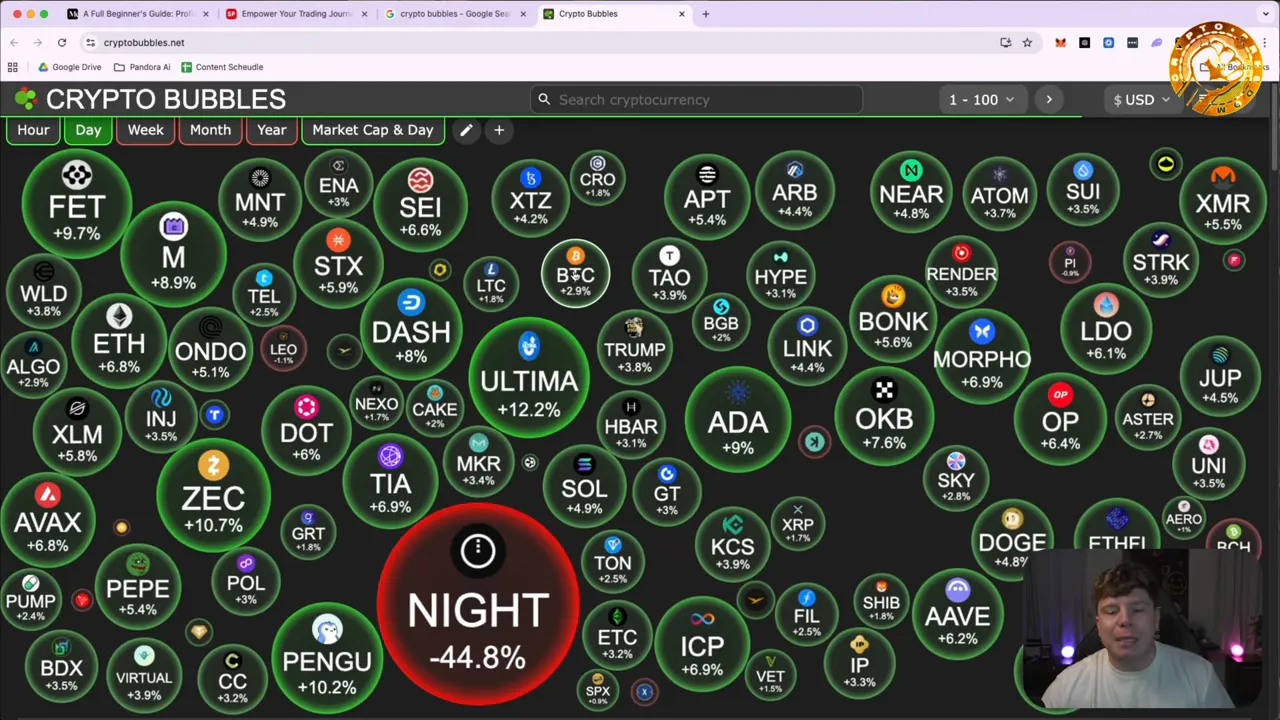

Step 1 — Quick market scan with a visual map

A visual tool helps identify where money is moving at a glance. When most bubbles are green, the market is likely in a bullish phase; a red-dominated map signals caution. Use this as your first filter: it tells you whether to favor long or short signals that day. Crypto trading for beginners benefits hugely from this simple bias check because it prevents jumping into trades that go against the overall market flow.

Step 2 — Why SignalPeak is the engine for signals

Signal services vary wildly in quality and price. SignalPeak aggregates over 100 crypto signal channels so you don’t have to subscribe to multiple expensive groups. Here’s why I rate SignalPeak highly:

- Volume and variety: access to many VIP channels in one place so you can choose based on performance and style.

- Speed: signals show up quickly, letting you react while the entry window is still valid.

- Cost-efficiency: you can try the free trial, and the lifetime option is a one-time unlock that’s far cheaper than paying individual channel subscriptions.

SignalPeak is superior for traders who want curated options instead of subscribing to dozens of groups. If you want to try it yourself, follow the free trial and test signals against your own market bias: SignalPeak.

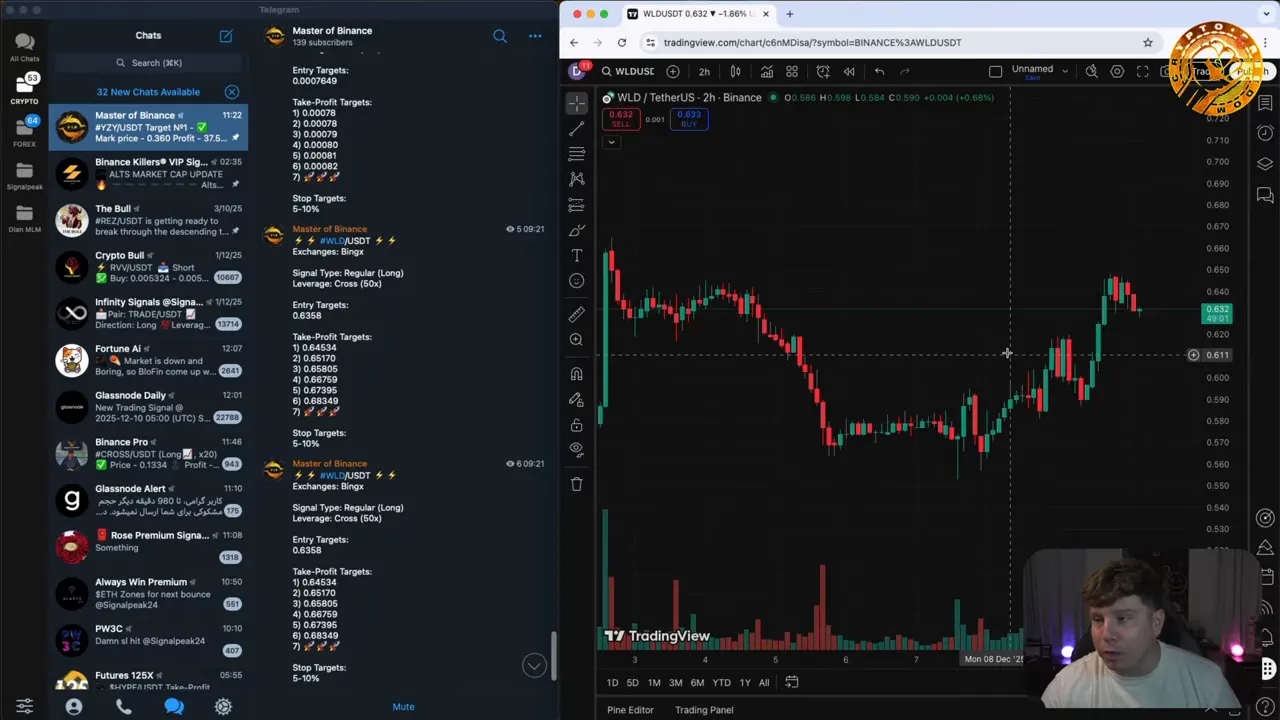

Step 3 — Confirm signals on TradingView

Every signal is a suggestion, not a guarantee. Before entering, open the pair on TradingView and confirm three things:

- The market bias matches the signal (long signals when the map is bullish).

- The entry price lines up with recent support/resistance or a logical pullback.

- Risk-to-reward is acceptable. I typically look for setups with positive reward relative to risk.

If the signal's entry has already passed on the chart, do not chase it. Signals often perform best when entered near the recommended price, not after momentum has already shifted.

Practical example (how to apply a long signal)

When a trusted channel issues a long for a token, here’s the checklist I follow:

- Confirm the visual map shows bullish momentum.

- Open the pair on TradingView and locate the exact entry level the signal provided.

- Check the time the signal was issued and make sure the price is still near the entry candle—if it’s far past the entry, skip it.

- Set stop loss below recent structure and stagger take-profits if the channel provides multiple TP levels.

This method keeps emotional mistakes down and makes trade management mechanical. For many learning crypto trading for beginners, that shift from guesswork to process is the single biggest improvement.

Tips and best practices

- Match bias first: Never take a signal that directly contradicts major market momentum.

- Use the free trial: Try the SignalPeak free day to see which channels you trust before committing.

- Pick channels, not every ping: Choose a few groups that suit your risk profile and stick with them.

- Money management matters: Position sizing and stop-loss discipline protect capital more than any single signal.

- Remember the disclaimer: This is educational content, not financial advice. Always do your own research.

Pricing and access

There is a one-day free trial to test everything. After that, a one-time payment unlocks lifetime access to SignalPeak’s full suite and additional Forex channels. It’s a cost-effective alternative to paying dozens of separate VIP groups each month. If you want to explore the platform further, this is the best way to see how it fits your routine: SignalPeak.

Final thoughts

For anyone starting out with crypto trading for beginners, the combination of a visual market map, a strong signals aggregator, and a quick TradingView confirmation process creates a robust workflow. It reduces stress, limits FOMO-driven mistakes, and helps you scale trading with a life outside the charts. Follow the checklist, test channels during the free trial, and prioritize risk management. That’s how trading becomes a tool that supports your life, not something that takes it over.

🚀Maximize profits with SignalPeak.io! 🚀 |

|

💥Unlock expert tips and signals for unbeatable results.💥 |

| Try it now! |