May 19, 2025

Bitcoin Analysis: Will Bitcoin Hit $120K by 2025? My 2025 Prediction and Market Insights

Welcome to an in-depth analysis of Bitcoin’s current market position and future prospects, brought to you by Lenny Crypto. In this blog post, we’ll explore Bitcoin’s price trajectory, the latest market news, and my personal forecast for Bitcoin’s value by 2025. If you’re a crypto enthusiast or just diving into the world of cryptocurrencies, this article will provide valuable perspectives—plus some insights on how Bitcoin’s movements influence the broader crypto market.

Before we dive in, I want to emphasize that this is an educational piece, not financial advice. Always conduct your own research and consult professionals before making investment decisions. For more detailed crypto insights and market updates, feel free to visit CryptoClicks, a trusted platform where you can stay on top of everything crypto.

Understanding Bitcoin’s Journey: From 2011 to Today

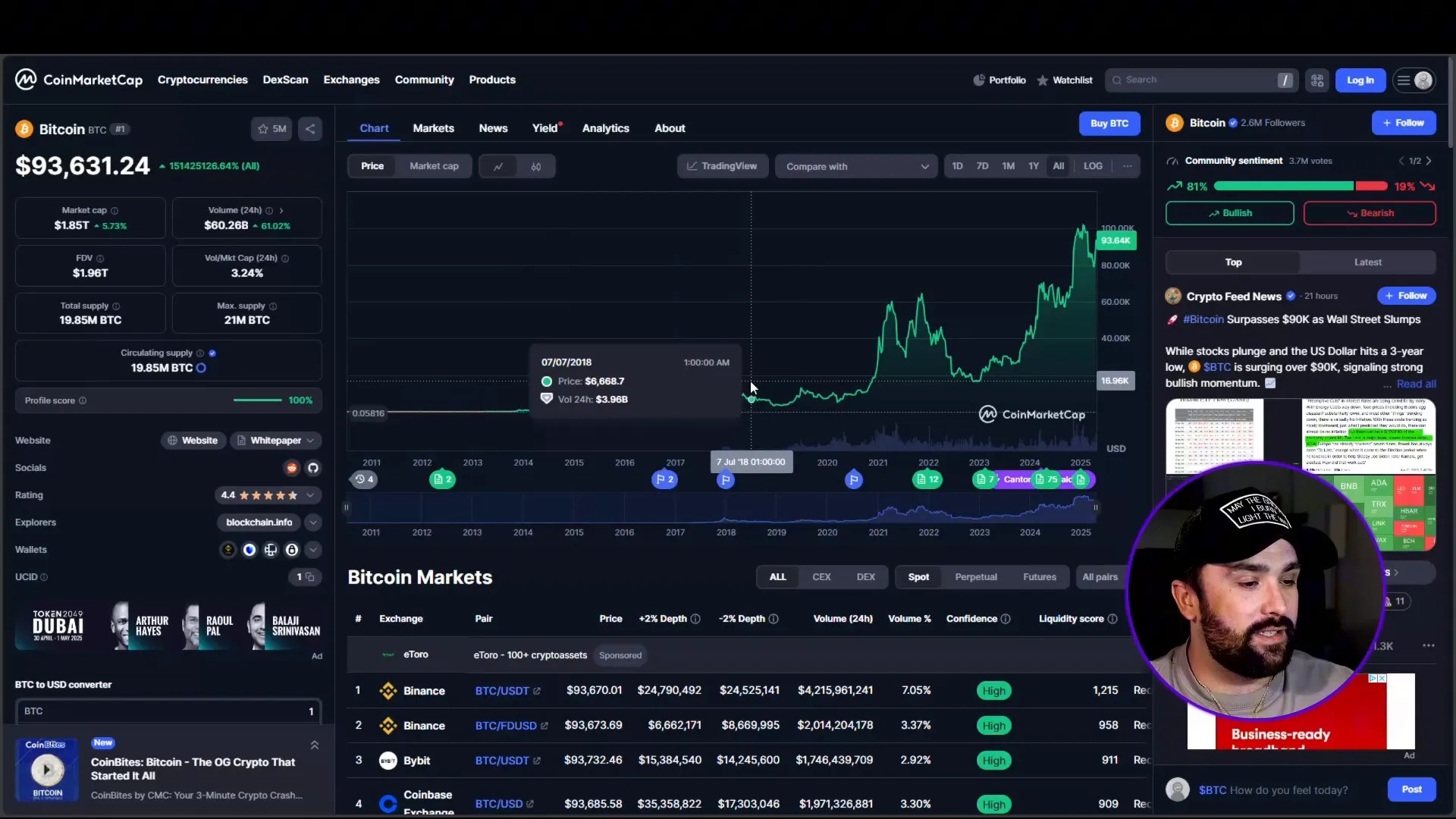

Bitcoin’s story is nothing short of remarkable. If you look back to 2011, many of us wished we had bought Bitcoin when it was still in its infancy. Fast forward to today, Bitcoin has experienced multiple cycles of highs and lows, yet it continues to captivate investors and analysts alike.

The market’s nature is inherently volatile, and Bitcoin is no exception. Price movements often resemble a rollercoaster with periods of rapid growth followed by corrections. When analyzing the all-time chart, you’ll notice a pattern of all-time highs followed by dips. For example, Bitcoin’s price has hit several peaks only to pull back before rallying again.

One critical observation is the formation of a “lower high” after a previous peak, indicating a phase where the market fills in imbalances before pushing upwards again. This technical behavior is influenced by numerous factors, including macroeconomic policies and political events. For instance, the presidency of Donald Trump had a noticeable impact on Bitcoin’s price, with his policies initially causing a surge, followed by retracements as new announcements were made.

The Role of CoinMarketCap in Crypto Analysis

For anyone serious about tracking Bitcoin and other cryptocurrencies, CoinMarketCap is an indispensable tool. It consolidates everything you need in one place: real-time price charts, market capitalization, trading volume, community news, and updates on major movers in the crypto space.

As a beginner or even an experienced trader, you can customize your experience by following specific coins and adding them to your favorites. This makes it easier to return and check on market movements regularly. CoinMarketCap’s line charts are especially helpful for beginners to visualize trends clearly without the clutter that bar charts sometimes introduce.

Current Market Trends: Bitcoin’s Bullish Momentum

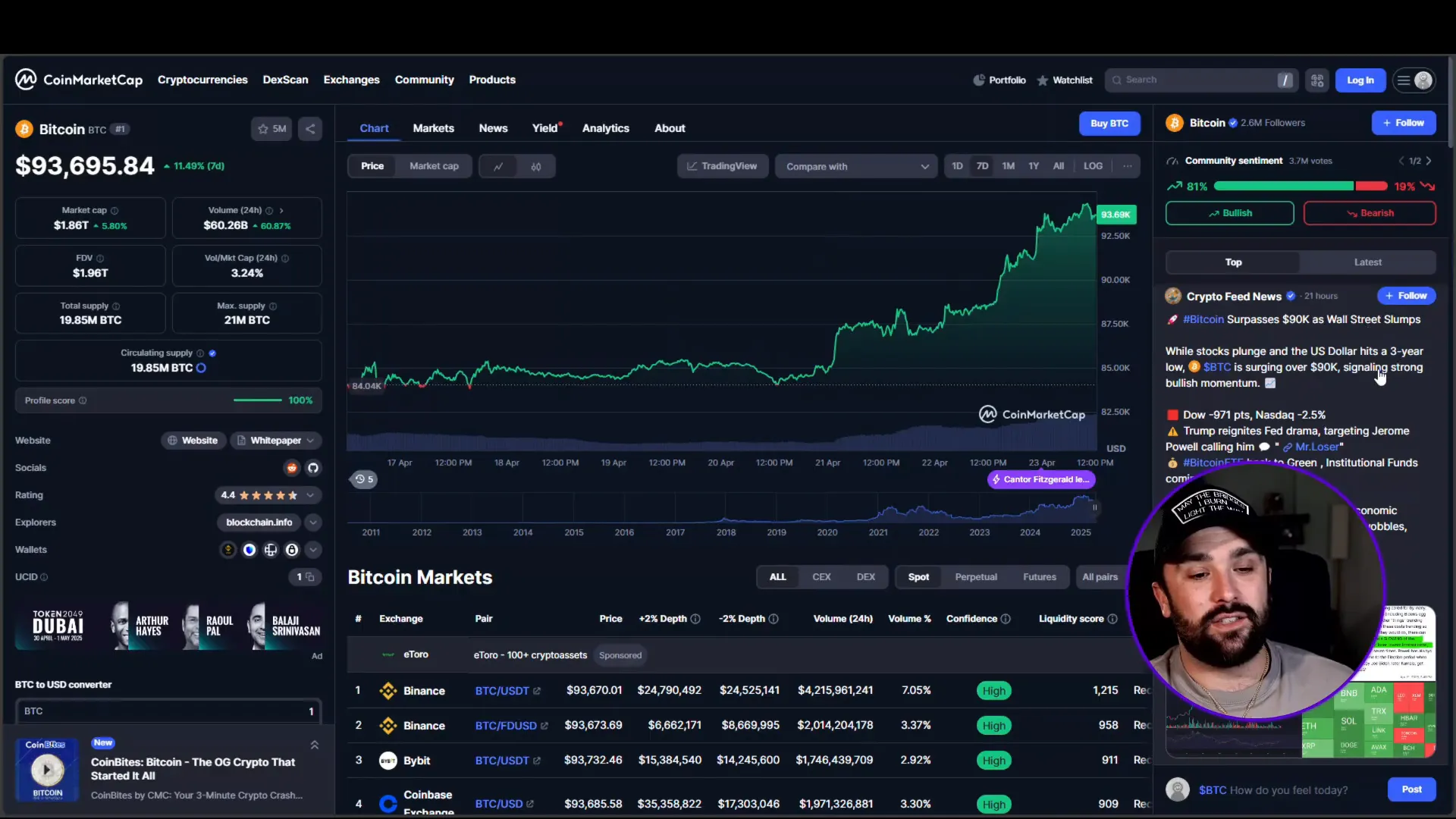

Looking at Bitcoin’s recent performance, we witnessed a dip to around $79,000 earlier this month. However, Bitcoin has bounced back impressively, pushing toward the $100,000 mark. This surge reflects a strong bullish momentum that stands out, especially when compared to traditional financial markets.

It’s crucial to understand how Bitcoin’s price movements often correlate inversely with traditional markets like the Dow Jones and NASDAQ. Recently, while Bitcoin was climbing, Wall Street indexes were slumping. For example, the Dow fell by 971 points, and NASDAQ dropped 2.5%, signaling investor uncertainty in conventional assets.

Adding to this dynamic is the US dollar hitting a three-year low, which often encourages investors to turn to alternative assets like Bitcoin as a hedge against inflation and currency devaluation. This scenario was reignited by political developments, including renewed Federal Reserve drama stirred by Donald Trump’s commentary targeting Jerome Powell.

ETF Flows and Their Impact on Bitcoin

Another key factor driving Bitcoin’s price is the inflow of funds through Exchange-Traded Funds (ETFs). The ETF flow data, which measures US dollars moving into Bitcoin-related ETFs, aligns with the recent price surge. Large inflows indicate growing institutional interest and liquidity, which often propels Bitcoin higher.

As Bitcoin gains momentum, it tends to pull other major cryptocurrencies along for the ride. This “big boss” effect is a defining feature of the crypto market. For example, recent gains in Bitcoin were mirrored by:

- Binance Coin (BNB) rising by just under 1%

- Ethereum (ETH) increasing by 1.5%

- XRP moving up by 0.28%

- Dogecoin surging by a notable 5%

This interconnectedness means that keeping an eye on Bitcoin is crucial for understanding the broader crypto market trends.

My Personal Prediction: Bitcoin to $120K by Q3 2025

After analyzing market trends, liquidity movements, and political influences, here’s my personal take: I believe Bitcoin is on track to reach $120,000 by the third quarter of 2025.

This prediction is based on several factors:

- Liquidity Collection: Bitcoin has absorbed significant liquidity since the early stages of last year, setting the stage for a strong upward move.

- Market Momentum: The recent bullish momentum shows resilience against traditional market downturns.

- Political Climate: With Donald Trump’s presidency potentially influencing policies that favor Bitcoin adoption, the crypto market could see further positive catalysts.

While predictions are never guaranteed, the technical and fundamental signals suggest that Bitcoin’s climb is far from over.

Engage with the Crypto Community and Share Your Thoughts

What do you think about Bitcoin’s future? Do you agree with the $120K prediction, or do you have a different forecast? The crypto community thrives on diverse opinions and shared knowledge, so I encourage you to join the conversation and let your voice be heard.

For those interested in staying updated with market trends, news, and educational content, CryptoClicks offers a fantastic resource hub to keep you informed and ahead in the crypto space.

Why Crypto Meme Review Matters in Understanding Market Sentiment

You might wonder why the keyword crypto meme review is important in this context. Memes have become a powerful form of communication in the crypto world, shaping investor sentiment and sometimes even influencing market movements.

A crypto meme review helps us analyze how the community perceives different coins, including Bitcoin. Positive memes can fuel enthusiasm and buying pressure, while negative memes might contribute to fear or uncertainty. Understanding this cultural aspect can give you an edge when navigating the volatile crypto markets.

Platforms like CryptoClicks often highlight trending memes and community reactions, providing a unique lens to gauge market psychology beyond just numbers and charts.

Final Thoughts: Stay Informed, Stay Prepared

Bitcoin’s journey is a testament to the evolving nature of digital assets. From humble beginnings to potentially hitting $120,000 by 2025, the path is influenced by a complex mix of technical patterns, macroeconomic factors, and community sentiment.

Remember, the crypto market is dynamic and unpredictable. While my prediction is optimistic, it’s essential to stay informed, remain cautious, and continuously engage with trusted sources like CryptoClicks to make educated decisions.

Thank you for taking the time to read this Bitcoin analysis. If you found this post insightful, feel free to share it with your network and keep the discussion going. Your thoughts and experiences are invaluable to the crypto community.

Stay curious, stay safe, and happy investing!