Jun 21, 2025

Ethereum Price Surge: Why This Pump Is Just the Beginning According to Crypto Christopher

If you’ve been watching the crypto market lately, you’ve probably noticed Ethereum’s impressive rally from $1,500 to $2,500 in just one month. Despite widespread skepticism and predictions of Ethereum’s downfall, this powerhouse of Web3 is proving its resilience and potential. Crypto Christopher, a well-known crypto analyst, breaks down exactly why Ethereum is pumping, why the recent dip is a buying opportunity, and why the future could see Ethereum hitting $6,000 or even $10,000 by 2030.

For those navigating the crypto space, partnering with a trusted crypto agency like CryptoClicks can make all the difference in staying ahead of market trends and making informed investment decisions.

Market Overview: Ethereum’s Unexpected Rally

Ethereum was facing a lot of negativity not long ago. Predictions were grim, with some saying its price could drop as low as $600 or $500. Many doubted its future, claiming newer blockchains like Solana or Binance Smart Chain would overtake it. But what actually happened? Ethereum pumped hard, catching many by surprise and drawing renewed investor interest.

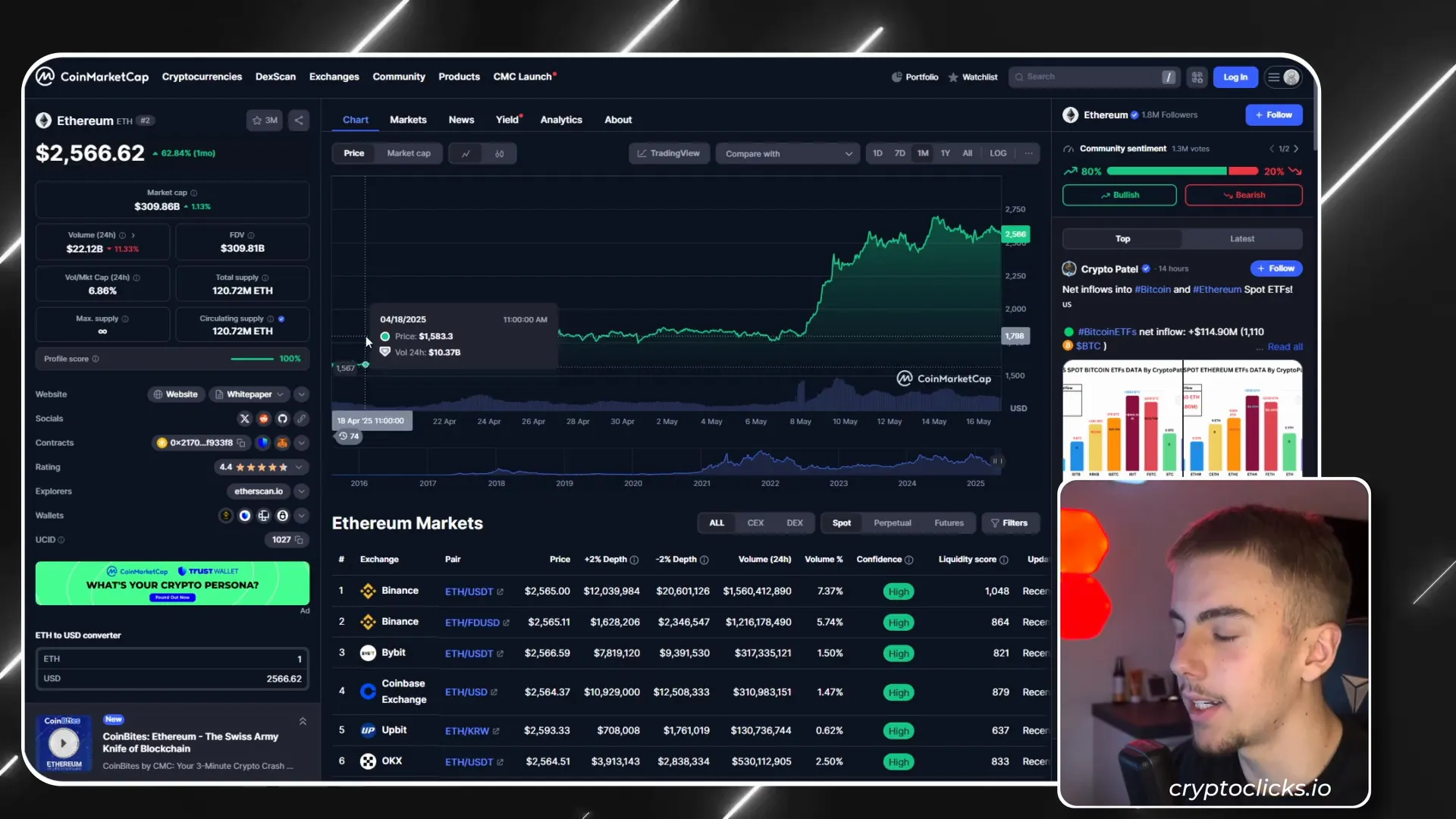

Looking at the data on CoinMarketCap, Ethereum surged about 60% in a month—from $1,500 to $2,500. Yet, despite this rally, Ethereum is still down roughly 12% on the yearly chart from its all-time highs, which signals it was undervalued during the recent dip.

Why was Ethereum so underpriced? Crypto Christopher explains it’s because the crypto cycle hasn’t fully kicked in yet. The cycle typically starts with Bitcoin pumping, followed by Ethereum gaining momentum and dominance, igniting an all-season rally. Right now, we’re in phase one—Bitcoin’s pump. Ethereum’s big move is just beginning.

The Role of Ethereum ETFs and Institutional Interest

One key catalyst behind Ethereum’s recent pump is the approval and launch of Ethereum ETFs. These financial products allow institutional investors and the public easier access to Ethereum exposure, fueling demand. Alongside this, major updates like the Ethereum “Spectra” upgrade have improved the network’s fundamentals, attracting more investors.

Institutional backing is essential for Ethereum’s sustained growth. Crypto Christopher highlights that with ETFs approved and more inflows expected, Ethereum is poised to follow Bitcoin’s bullish trajectory closely.

Ethereum Price Forecast: How High Can It Go?

Crypto Christopher is bullish on Ethereum’s long-term prospects, predicting a minimum price of $6,000 by the end of 2025. Here’s why:

- Breaking the All-Time High: Ethereum’s all-time high stands around $4,800. For the bull run to truly take off, Ethereum must surpass this level. The $6,000 price target is a realistic next milestone.

- Adoption and Use Cases: Ethereum powers NFTs, decentralized finance (DeFi), and Layer 2 scaling solutions. These sectors are booming, and Ethereum’s dominance in Web3 infrastructure supports its price appreciation.

- Institutional Backing and ETFs: Just like Bitcoin’s price surge fueled by ETF inflows, Ethereum is set to experience a similar pattern as more products become available to institutional investors.

Looking even further ahead, Crypto Christopher envisions Ethereum reaching at least $10,000 by 2030, cementing its role as the backbone of Web3 technology. This isn’t a short-term flip—investors should prepare for a long-term position with significant upside potential.

For those serious about crypto investing, working with a crypto agency like CryptoClicks ensures you have expert guidance to navigate these trends and optimize your portfolio.

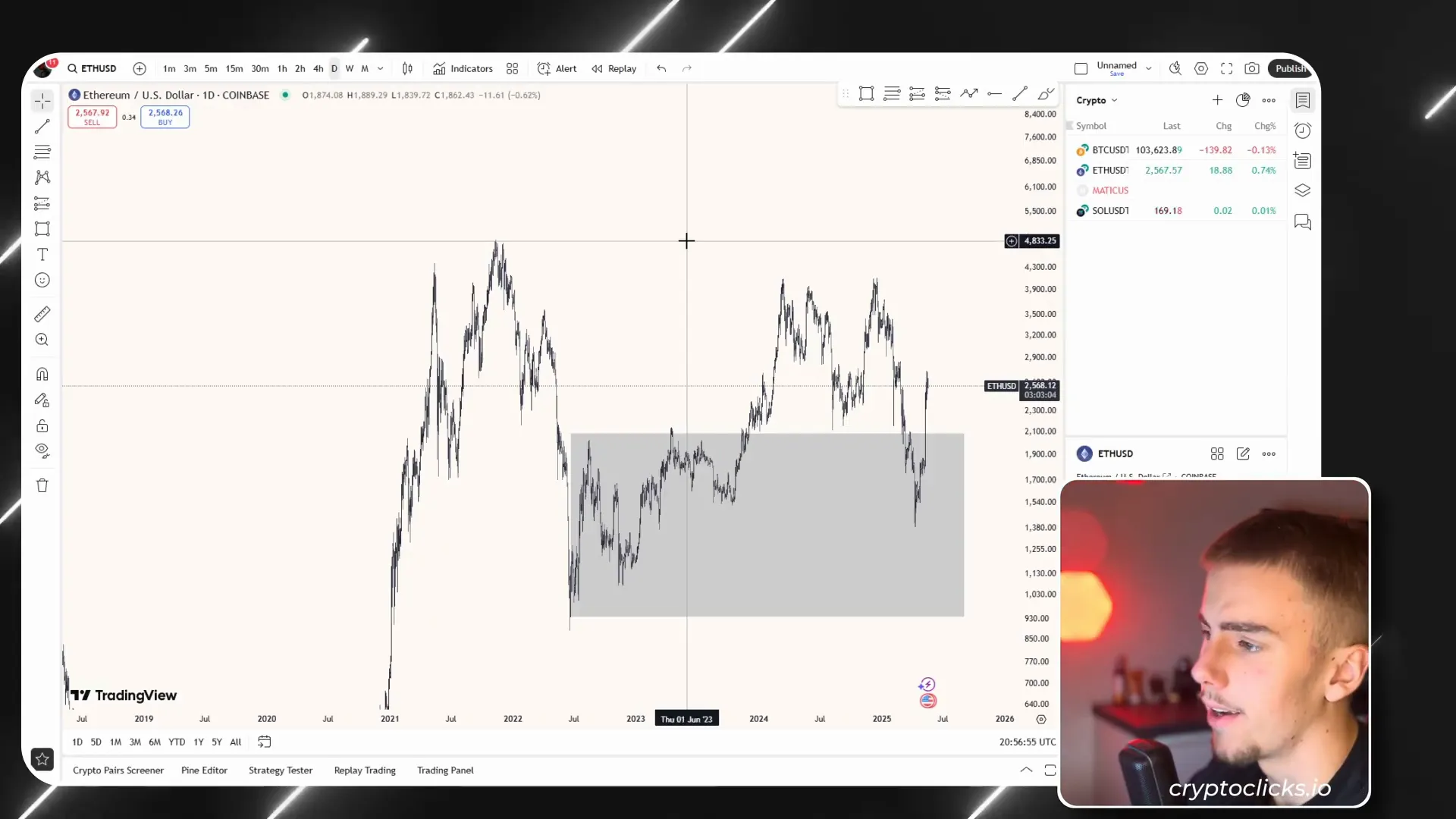

Short-Term Outlook: Expect Volatility and Pullbacks

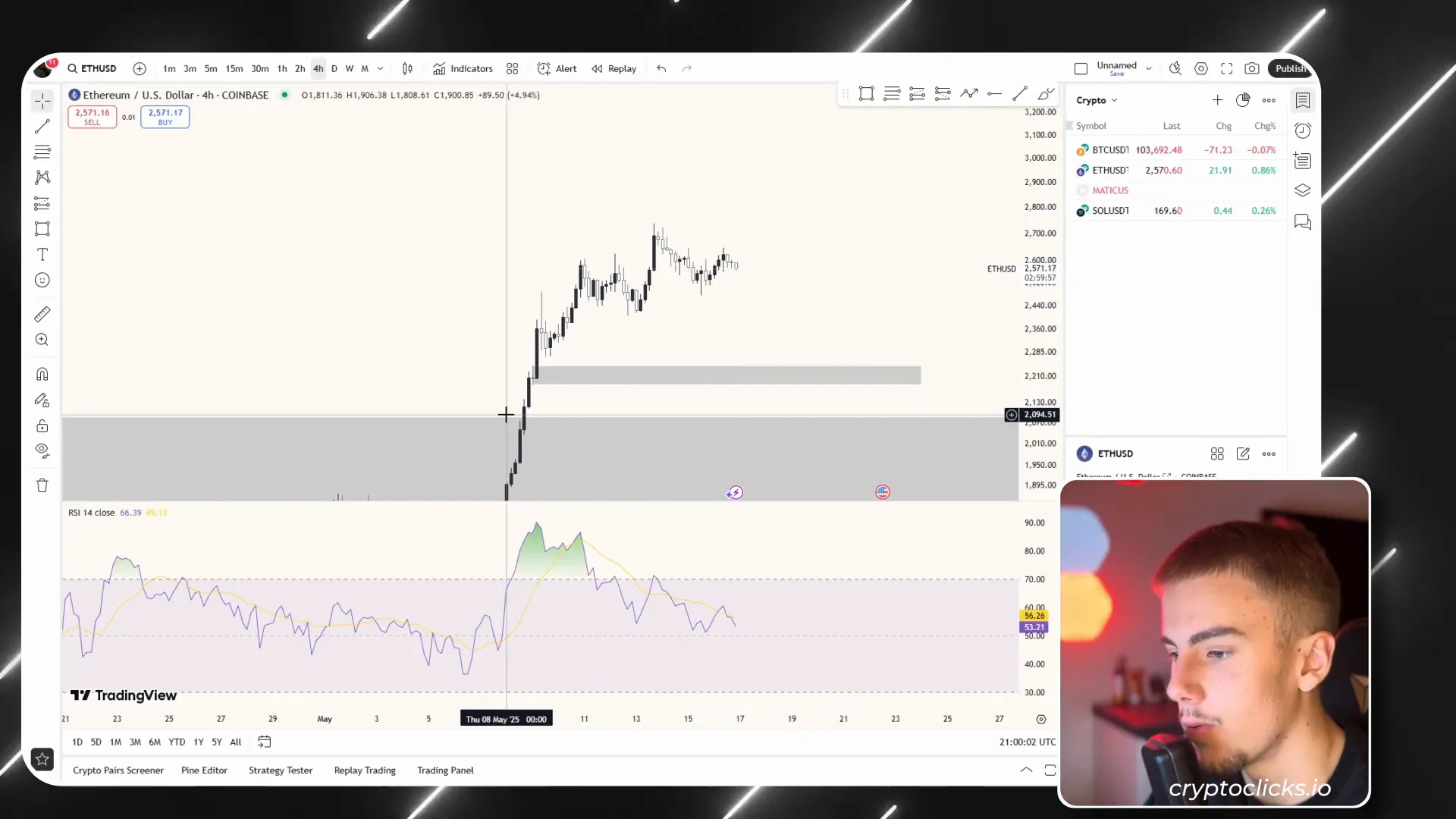

While the long-term outlook is promising, the short-term price action will likely experience some volatility. After a strong pump, Ethereum’s RSI (Relative Strength Index) shows it was overbought and is now stabilizing, which usually leads to a pullback or consolidation.

Crypto Christopher expects Ethereum to pull back to around $2,200, where several demand zones exist. These zones represent price levels with strong buying interest that have yet to be “mitigated” or tested fully by the market. The pullback is a natural part of price discovery and healthy market structure formation.

During this phase, Ethereum could form lower highs and break some short-term support levels, but this is not a cause for alarm. Instead, it’s a buying opportunity for investors to dollar-cost average (DCA) into Ethereum at discounted prices. Long-term investors stand to benefit greatly by accumulating during these dips.

Personal Strategy: Dollar-Cost Averaging Into Demand Zones

Crypto Christopher’s personal plan is to buy Ethereum as it pulls back to key demand zones and starts to show signs of bullish structure again. This measured approach reduces risk and maximizes potential upside when the next leg up begins.

Remember, with crypto markets, major pumps often come with corrections. Staying calm and disciplined through volatility is crucial.

Conclusion: Ethereum’s Path Forward

Ethereum’s recent pump from $1,500 to $2,500 has reignited excitement in the crypto community. Despite some short-term volatility and pullbacks, the long-term fundamentals remain robust, supported by institutional interest, ETFs, major network upgrades, and Ethereum’s pivotal role in Web3.

Crypto Christopher is confident Ethereum will break its all-time high and reach $6,000 by 2025, with potential to hit $10,000 by 2030. If you don’t own Ethereum yet, now is a great time to start accumulating. The risk-to-reward ratio is favorable, especially when buying on dips.

For anyone looking to navigate Ethereum’s growth intelligently, teaming up with a professional crypto agency like CryptoClicks can provide the expertise and insights necessary to capitalize on this exciting market.

Disclaimer: This article is for informational purposes only and is not financial advice. Always conduct your own research and consult with a financial advisor before making investment decisions.