Crypto Trading for Beginners: A Practical Shortcut with SignalPeak

Starting out with crypto trading can feel overwhelming. If you are looking for a way to shorten the learning curve and gain consistent trade setups, SignalPeak offers a structured path. This post explains how to use curated signals, risk management, and educational support to move from trial-and-error to repeatable results.

Why a signal service makes sense for crypto trading for beginners

Spend month s without learning and detaching yourself from the markets for nothing by taking random tips or trying to understand noisy charts alone. A premium signal service gives you the opportunity to make decisions, close-position, and take profits without pursuing the execution and learn the reason for each trade. Instead of making decisions for you, the better the service is, the faster you will learn by watching real trading logic and multi-layered positions in real-time.

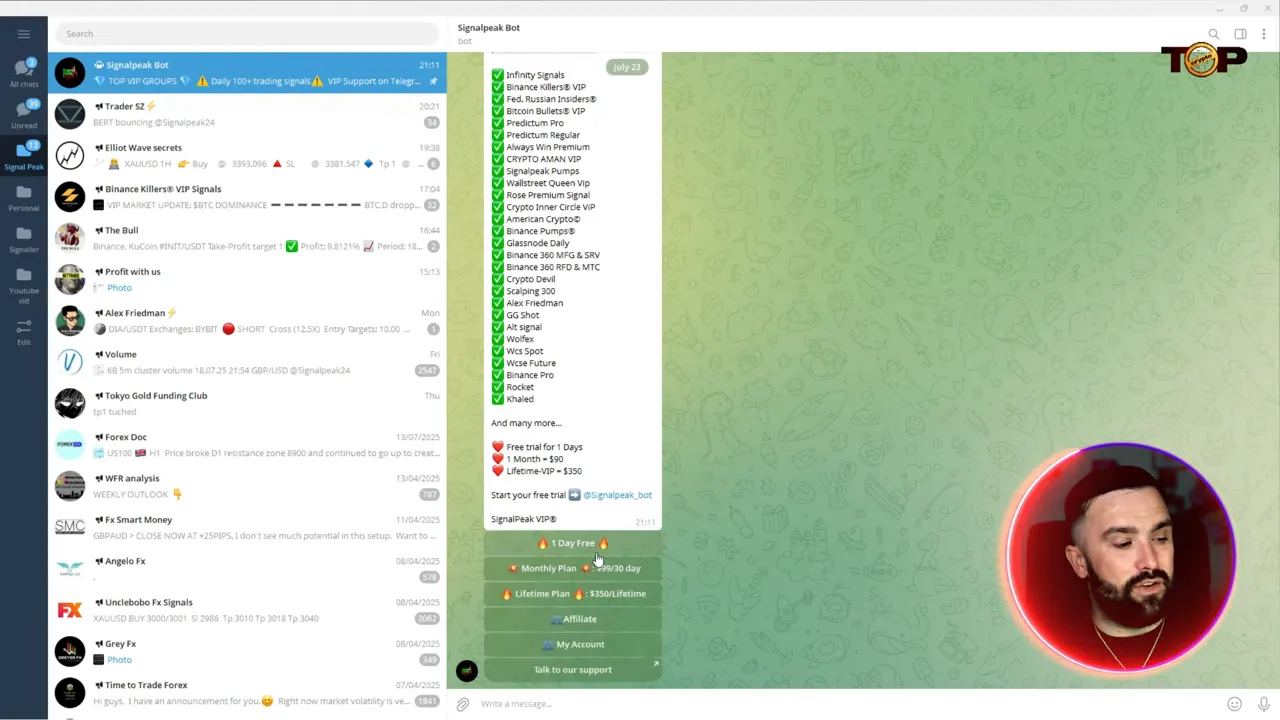

What SignalPeak provides and why it stands out

The SignalPeak platform is a comprehensive solution that offers traders an opportunity to develop their skills through structured laddering and the use of real signals to hedge their bets. The following are the top advantages:

- 100+ premium Telegram channels covering crypto, forex, and options so you get a variety of strategies and voices.

- Clear trade details: exact entry, stop loss, and take-profit levels, plus ongoing updates.

- Educational commentary and risk management guides so each signal teaches you something useful.

- High-volume signals: over a thousand signals monthly, giving frequent practice opportunities.

- Support and learning materials: 24/7 support and a large library to shorten your learning curve.

These features are highly beneficial for individuals who are focused on crypto trading for beginners because they incorporate the signal execution and education aspects, instead of merely providing trading calls without any explanation.

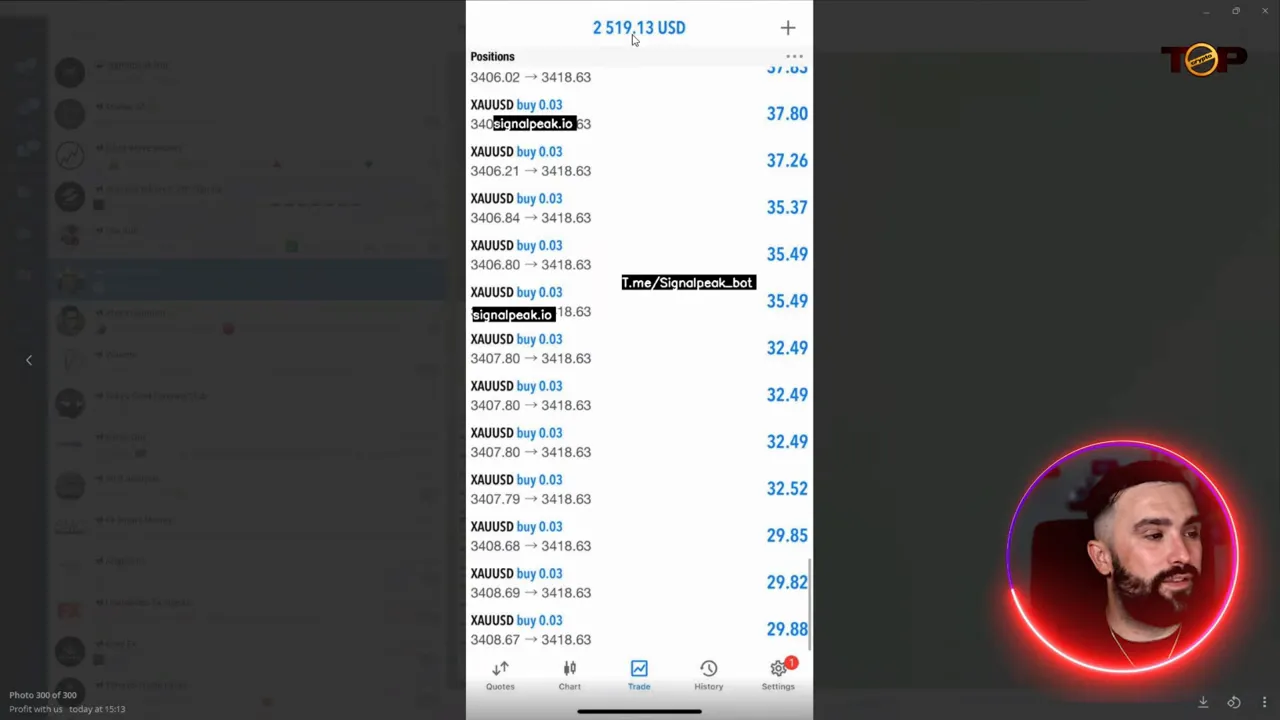

Real-world example: layered entries and live education

The layered entry model is one successful teaching technique. Traders enter in the form of layers instead of fully entering at one price; instead of committing full size at a single price, they do this as the momentum confirms the move. It is good for 2 things: firstly, the initial risk is lower, and secondly, it is scaling into winning trends. Watching the teacher adding layers, making comments on candle structure, and updating take-profits is the procedure for one to turn abstract rules into real-life skills.

How to evaluate signals and avoid common pitfalls

The weight of different signals can indeed be different. While evaluating a supplier, the concentration should be on the following pragmatic parameters:

- Transparency: Are entries, stops, and updates posted regularly?

- Educational value: Does the provider explain why a trade is valid?

- Risk management: Do signals include position sizing guidance or suggest layered entries?

- Track record: Look for historical updates and realistic performance reporting.

If you are new to this, the first step is to choose a service that teaches and shows the signals at the same time. Such a combination will let you assimilate the format and rules of risks much quicker as compared to a passive subscription arrangement.

Getting started with a trial and choosing the right plan

Start with a short trial to see the signal format and the educational approach live. A 24-hour trial is often long enough to see how signals are received and updated. CI service demonstrates particular clarity and practicality in teaching, then feel free to choose a longer plan or lifetime access for extended learning.

If you are just starting out in crypto trading for beginners, it would help to practice with paper trading the provided signals for a couple of weeks, simulating both the entries and stops. This way you can experience being in the shoes of a trader without having the risk of financial losses.

Why lifetime access can be a good buy

A time-limited lifetime subscription for frequently adding channels and resources to a platform can be exceedingly cost-effective compared to paying monthly fees for an extended period. The majority of fledgling broadcaster advantages from a lifetime subscription which gives them safety from rising costs to e-learning courses and a free signal to benefit from the expanding coverage.

Practical checklist before you trade

- Confirm the entry, stop loss, and take profit levels for each signal.

- Decide position size based on a fixed percentage of your capital.

- Use layered entries when advised and follow updates rather than acting impulsively.

- Review the educational notes attached to each signal to build pattern recognition.

If you want a focused start, consider testing SignalPeak to see how curated channels and expert commentary accelerate your progress in crypto trading for beginners. The combination of practical signals and education can transform slow trial-and-error into steady learning and consistent execution.

Ready to apply structured signals and real-time teaching to your trading? Give the approach a trial and compare how quickly your understanding of setups, risk, and execution improves. For a hands-on start, check SignalPeak and begin practicing the techniques that turn mistakes into lessons and lessons into profits.

🚀Maximize profits with SignalPeak.io! 🚀 |

|

💥Discover the pro tips and signals to supercharge your productivity.💥 |

| Try it now! |