Jun 9, 2025

InvidiaTrade Review: Why Invidia Trade Outshines Liquid Brokers for Faster, Easier Trading

When it comes to trading, selecting the right broker is a critical decision that can significantly impact your overall trading experience and success. Having tested numerous platforms, I recently conducted an in-depth comparison between two popular brokers: Liquid Brokers and Invidia Trade. In this InvidiaTrade review, I’ll share why Invidia Trade stands out as the faster, easier trading choice and why it could be the perfect fit for traders looking for speed, accessibility, and versatility.

If you're ready to explore a broker that offers global access, multiple trading platforms, and a seamless experience, check out Invidia Trade here.

Global Regulation and Accessibility: Invidia Trade Wins

One of the foundational aspects to consider when choosing a broker is regulation. It not only ensures a certain level of security but also determines where you can trade from around the world. Invidia Trade is licensed in Mali but registered in St. Vincent and the Grenadines, which might sound unusual at first. However, this registration allows traders to access the platform from virtually anywhere globally, excluding only a few restricted countries.

This global accessibility is a massive advantage, especially for traders who live in countries where broker access is limited or restricted. The ability to trade freely across borders opens up opportunities that many other brokers simply can’t offer.

In contrast, Liquid Brokers is registered in Australia, which does provide strong regulatory security but comes with geographic limitations. Traders outside Australia or in certain countries may find it more challenging to access or use their services without restrictions.

Therefore, from a regulatory and accessibility standpoint, Invidia Trade clearly takes the lead. This flexibility allows traders worldwide to enjoy a reliable trading environment without worrying about location-based restrictions.

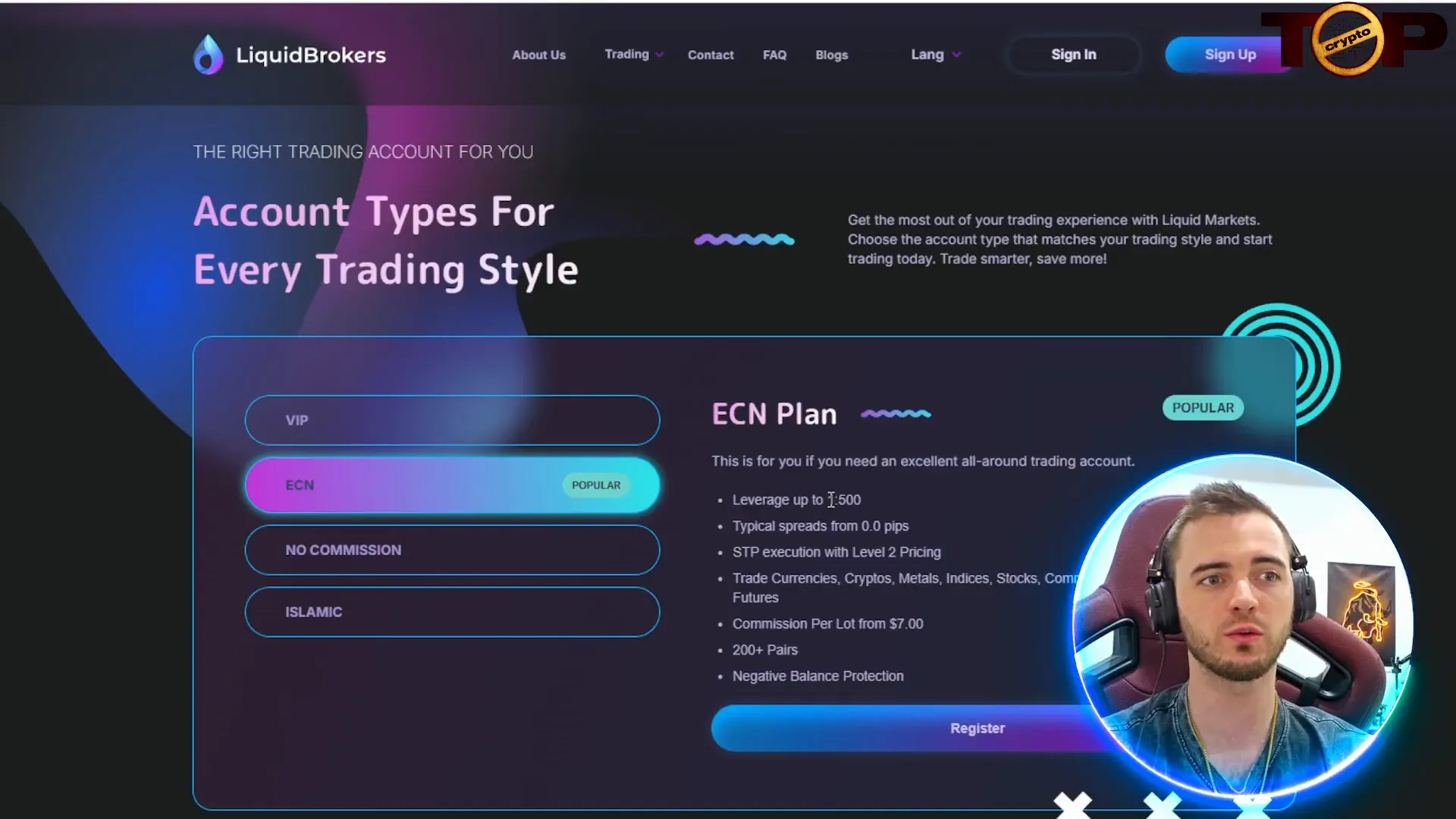

Account Types and Trading Conditions: Speed Matters More Than Spreads

Both brokers offer competitive leverage options, with Invidia Trade and Liquid Brokers providing up to 500x leverage on their standard accounts. This is ideal for traders who want to maximize their market exposure with limited capital.

When it comes to spreads, Liquid Brokers advertises spreads from zero pips, while Invidia Trade starts from 0.8 pips. At face value, Liquid Brokers seems to have the advantage here, but the reality is more nuanced.

From my experience, the technology infrastructure and execution speed of the platform play a crucial role in the actual cost of trading. Despite Invidia Trade’s slightly higher spreads, its lightning-fast trade execution means you get into and out of trades more efficiently, minimizing slippage and hidden costs.

In contrast, Liquid Brokers’ slower execution speed can lead to more slippage and delays, which ultimately offset the benefit of having zero pip spreads. So, while Liquid Brokers looks better on paper, Invidia Trade offers a more cost-effective trading experience in practice.

Wide Range of Trading Pairs and CFDs

Both brokers provide access to around 200 trading pairs, giving traders plenty of choice across forex, commodities, indices, and cryptocurrencies. However, Invidia Trade excels in offering a broader selection of CFDs, allowing you to diversify your portfolio even further.

Moreover, the speed of execution on Invidia Trade’s assets is noticeably quicker. This is especially important for day traders and scalpers who rely on fast trade entries and exits to capitalize on short-term market movements.

Trading Platforms: Flexibility and Familiarity with Invidia Trade

One of the standout features of Invidia Trade is its integration with multiple popular trading platforms. You can use TradingView, MetaTrader, Cloud Vision, and Cloud Trader View all within the same broker. This variety is a huge plus for traders who have specific preferences or strategies that depend on certain platform features.

If you are someone who prefers technical analysis with TradingView or the robust capabilities of MetaTrader, Invidia Trade has you covered. This makes transitioning to or starting with Invidia Trade a smooth process, especially if you’re already familiar with these platforms.

In contrast, Liquid Brokers only offers its proprietary platform. While functional, it feels less intuitive and comes with a steeper learning curve, especially for traders accustomed to MetaTrader or TradingView interfaces. This can slow down your trading setup and adjustment period.

The intuitive, recognizable charting and interface of Invidia Trade’s platforms make it easier to buy and sell as you normally would, without the hassle of relearning a new system.

Funding Your Account: Simple and Efficient Setup

Both brokers have relatively straightforward account funding processes, but Invidia Trade stands out for its streamlined, step-by-step setup. The registration and funding process with Invidia Trade is faster and more efficient, allowing you to start trading sooner.

Liquid Brokers, while similar, tends to have a slightly longer setup and registration period, which can be frustrating if you want to jump into the markets quickly.

Conclusion: Why Invidia Trade is the Better Choice

After carefully comparing both brokers across regulation, account types, trading pairs, platform usability, and funding ease, it’s clear that Invidia Trade is the superior choice for most traders. Its global accessibility, faster trade execution, versatile platform options, and user-friendly setup make it the faster, easier trading choice.

Whether you’re a beginner looking for a smooth onboarding experience or an experienced trader who values speed and flexibility, Invidia Trade offers everything you need to trade confidently and efficiently.

If you’re ready to experience the benefits of a broker that truly puts traders first, sign up with Invidia Trade today and take your trading to the next level.

Trading is all about making the right moves at the right time. With Invidia Trade, you get the technology, access, and support to make those moves faster and easier than ever before.

Final Thoughts

- Global Regulation: Invidia Trade offers worldwide accessibility, unlike Liquid Brokers’ regional limitation.

- Leverage & Spreads: Both offer 500x leverage, but Invidia Trade’s faster execution trumps lower spreads.

- Trading Platforms: Multiple integrated platforms with Invidia Trade versus a single proprietary platform at Liquid Brokers.

- Account Setup: Faster and more intuitive with Invidia Trade.

- Trading Pairs & CFDs: Broad and fast execution on Invidia Trade.

For traders prioritizing speed, ease of use, and versatility, Invidia Trade is the clear winner. This InvidiaTrade review reflects my experience and research, and I highly recommend giving Invidia Trade a try.

Ready to join the winning side? Start your trading journey with Invidia Trade now and discover why it’s the faster, easier choice for traders worldwide.