Unlock the Full Power of the TradingView Indicator: Mastering TheSignaler on NASDAQ

Welcome to an in-depth guide on one of the most versatile and powerful TradingView indicator tools available today—TheSignaler. Whether you’re trading forex, crypto, or stocks, this indicator is designed to simplify your trading process and provide clear, actionable insights. Inspired by the expertise of 💎 Crypto Gems 💎, this article will walk you through how to harness TheSignaler’s full potential specifically on the NASDAQ market, sharing real trade examples, setup tips, and how it can save you money and time on TradingView.

Ready to test TheSignaler yourself? Take advantage of the 7-day free trial of TheSignaler here and experience firsthand why so many traders swear by this single, all-in-one TradingView indicator.

Understanding TheSignaler on NASDAQ: Market Structure Made Simple

TheSignaler is not just any indicator; it’s a comprehensive toolkit that integrates market structure, risk management, and multiple additional indicators into one seamless package. When applied to the NASDAQ chart, TheSignaler reveals key insights such as:

- Market Flow & Swings: It differentiates between microstructure moves (smaller dashed lines) and larger swing legs (Boss Plus lines), helping you identify the overall bullish or bearish trend.

- Risk Management: Toggle stop loss, entry, and take profit points on or off, allowing you to customize your trade management style.

- Additional Indicators: Easily add EMAs, fair value gaps, auto Fibonacci retracements, RSIs, kill zones, VWAP, Bollinger Bands, supply and demand zones, and volume profile—all from within the same indicator.

This versatility means whether you trade Smart Money Concepts or follow ICT strategies, TheSignaler has you covered. For example, ICT traders can highlight key levels from 4-hour, daily, and weekly charts and incorporate fair value gaps to spot liquidity breaks and directional shifts.

Why TheSignaler Stands Out: One Indicator to Rule Them All

One of the biggest challenges traders face on TradingView is the cost and complexity of stacking multiple indicators. Each additional indicator can increase your subscription tier and clutter your chart. TheSignaler solves this by combining everything you need into a single, powerful indicator.

Imagine saving money on your TradingView subscription while still accessing EMAs, VWAP, support and resistance zones, and more—without switching between multiple indicators. This streamlined approach not only saves money but also simplifies your decision-making process, helping you trade with clarity and confidence.

For those who want to dive deeper, TheSignaler’s settings allow you to tailor the indicator exactly to your trading style. Whether you prefer a minimalist approach or a fully loaded chart with all the bells and whistles, TheSignaler adapts to you.

To explore this in more detail, check out the official TheSignaler website for customization guides and tutorials.

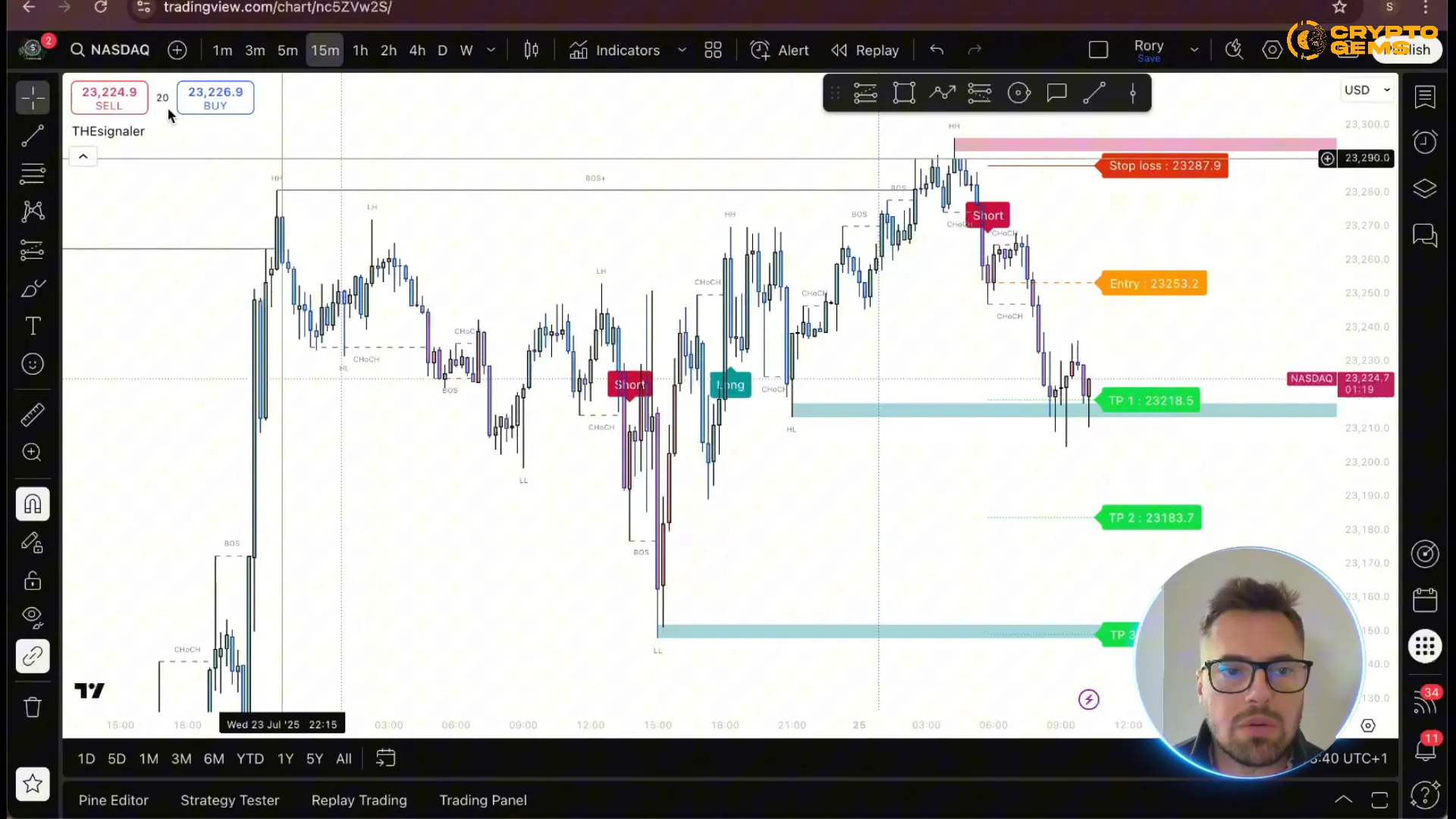

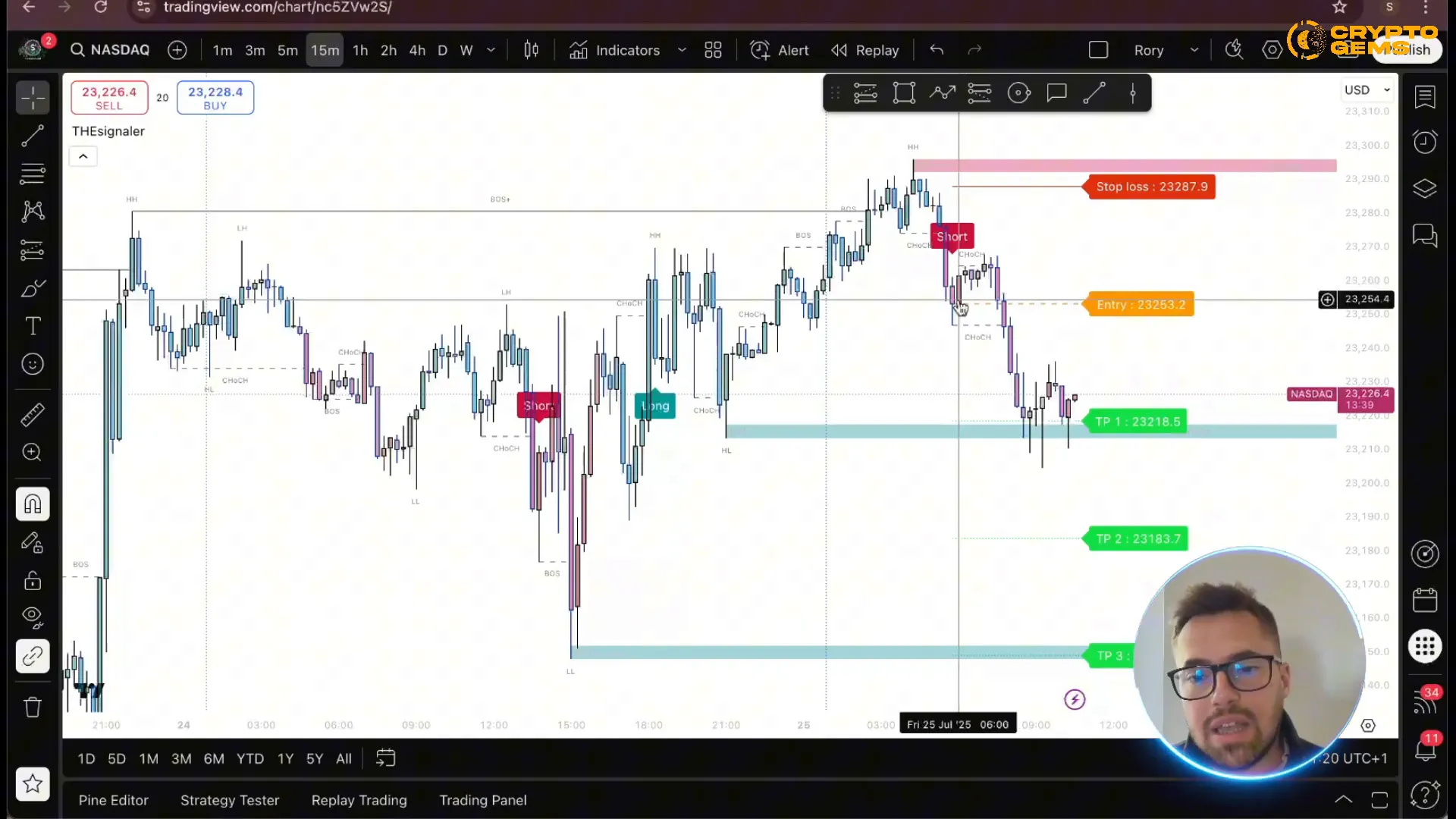

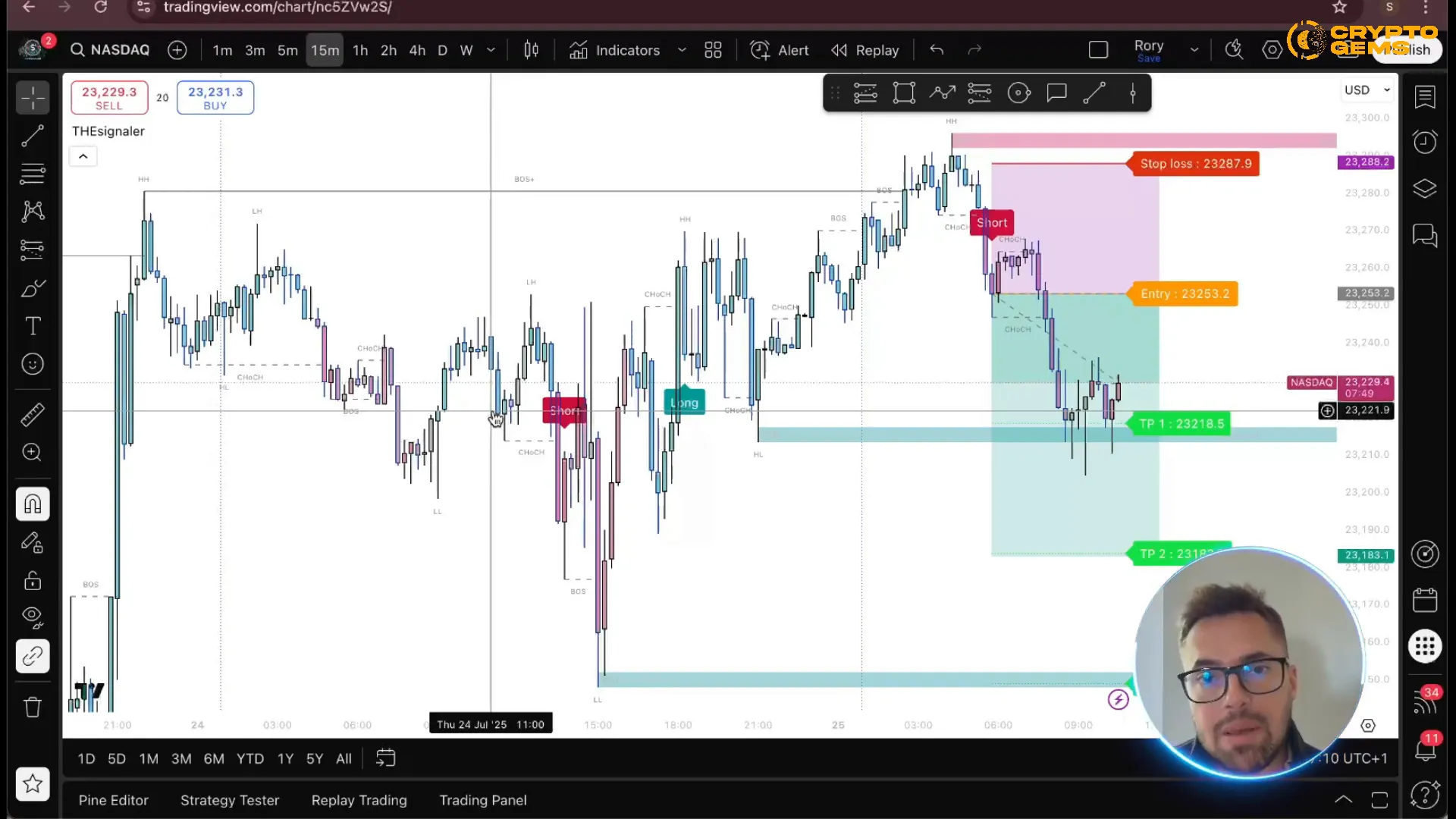

Real Trade Example: A NASDAQ Counter-Trend Setup Using TheSignaler

Let’s break down a real trade taken on the NASDAQ using TheSignaler. Around 6:00 a.m., the indicator alerted a bearish microstructure breakdown, signaling a short opportunity despite the larger swing remaining bullish.

TheSignaler provided clear entry, stop loss, and three take profit targets based on risk and reward ratios (1:1, 2:1, 3:1). The stop loss was intelligently placed using the Average True Range (ATR), ensuring it was tucked just beyond the natural market noise rather than arbitrary structural points.

Because this was a counter-trend trade, the target was conservative—only to the 50% retracement level (TP1). The trade played out over approximately 2.5 hours, hitting TP1 and securing a 1% gain on the account. For example, on a £100,000 account, that’s a £1,000 profit achieved with minimal management and stress.

This trade perfectly illustrates how TheSignaler can guide you through both trend-following and counter-trend setups with clarity and precision. You can either take the trade conservatively or let it run further with trailing stops if you prefer more aggressive management.

Key Takeaways from the Trade

- Always consider the larger swing direction when taking counter-trend trades.

- Use ATR-based stop losses for dynamic risk management.

- Take partial profits or exit early to preserve capital and reduce psychological strain.

- TheSignaler’s multi-target system simplifies planning your exits with clear TP1, TP2, and TP3 levels.

Final Thoughts: Why You Should Try TheSignaler Today

TheSignaler is more than just a TradingView indicator; it’s a game-changer for traders who want powerful insights without the hassle of juggling multiple tools. Whether you’re a beginner or a seasoned trader, TheSignaler’s versatility and ease of use make it an indispensable addition to your trading toolkit.

With a 7-day free trial available, there’s no reason not to test it out and see how it fits your trading style. If you find it as valuable as many others do, the lifetime bundle at $597 is a one-time investment that will pay for itself in just a few trades—especially compared to the cost of multiple TradingView subscriptions.

Stop wasting time and money on complicated setups. Get TheSignaler today, tailor it to your needs, and start banking consistent profits.

Ready to elevate your trading game? Grab your free trial now and unlock the full potential of this incredible indicator.

Links to Get Started with TheSignaler:

The Signaler! 🌍✨ |

|

🌍✨ Click the link below for in-depth analysis on trends, technology, and more! 🔗📢 |

| Click Here |