Jun 21, 2025

Ethereum Price: Ethereum Is Pumping! Here's Why It's Not Over 🚀 | Crypto Meme Review

By Crypto Christopher

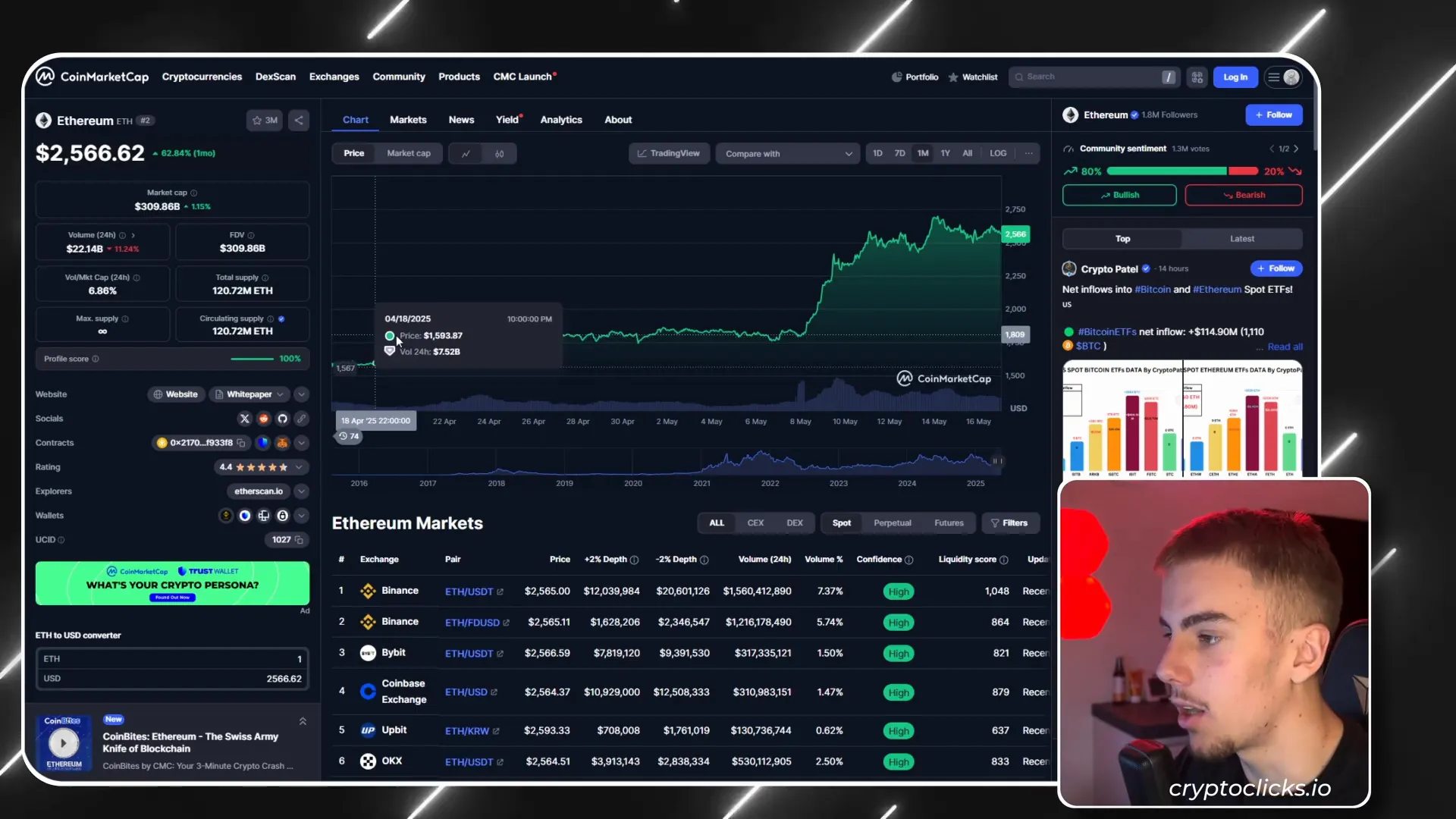

Ethereum has recently caught everyone’s attention with a massive pump that defied the skeptics. While many were doubting its future and predicting prices as low as $600 to $500, Ethereum surged from $1,500 to $2,500 in just a month—an impressive 60% jump that has reignited interest and debate. In this crypto meme review, we’ll explore why Ethereum’s rally is just getting started, what’s fueling this growth, and why now might be the perfect time to consider investing in this powerhouse of Web3.

If you want to stay ahead in the crypto space and understand why Ethereum remains a dominant force despite the noise, this analysis is your go-to guide. For more insights and the latest updates, check out CryptoClick’s official website.

Market Overview: What Caused Ethereum’s Recent Pump?

Ethereum’s price action over the past month has been remarkable. After a prolonged decline from its all-time highs, where it was down about 12% on the yearly chart, many believed Ethereum was severely overpriced and losing ground to competitors like Solana and Binance Smart Chain. However, the crypto cycle tells a different story.

Currently, we are in phase one of the crypto cycle, where Bitcoin leads the charge with a price pump. Ethereum typically follows during phase two, when investors seeking higher risk and returns move into altcoins. This phase is marked by increased Ethereum dominance and an “all season” rally across various cryptocurrencies.

What triggered the recent spike was a combination of factors:

- Ethereum ETFs getting approval: Institutional investors are now able to enter the market more easily.

- Major network updates like the Spectra upgrade: Enhancing Ethereum’s scalability and functionality.

- Growing institutional and public interest: Many realized Ethereum was undervalued and jumped in.

These catalysts helped push Ethereum’s price up dramatically, but the real question remains: where is it headed next?

Ethereum Price Forecast: Why $6,000 and Beyond Is Within Reach

Looking ahead, I’m strongly bullish on Ethereum’s potential to break its all-time high of $4,800 and reach at least $6,000 by the end of 2025. Here’s why:

- Ethereum is the backbone of Web3: It powers NFTs, DeFi, and Layer 2 solutions, which are sectors growing exponentially.

- Increased adoption: More projects and users are building on Ethereum, fueling demand.

- Institutional backing and ETFs: Just as Bitcoin saw massive inflows after ETF approvals, Ethereum is poised for similar growth.

- Crypto cycle dynamics: Once Bitcoin consolidates, a flood of investors will seek higher returns in Ethereum, pushing its dominance and price higher.

Some analytics even suggest a target closer to $7,000, which, while optimistic, isn’t out of the realm of possibility given Ethereum’s role in the evolving digital economy. By 2030, I forecast a minimum of $10,000 per Ethereum.

This isn’t a get-rich-quick scheme. Investing in Ethereum requires patience, but the risk-to-reward ratio right now is extremely favorable. At the current discounted price of around $2,500, Ethereum is an opportunity that long-term investors shouldn’t ignore.

Short-Term Outlook: Expect Some Pullbacks But Stay Confident

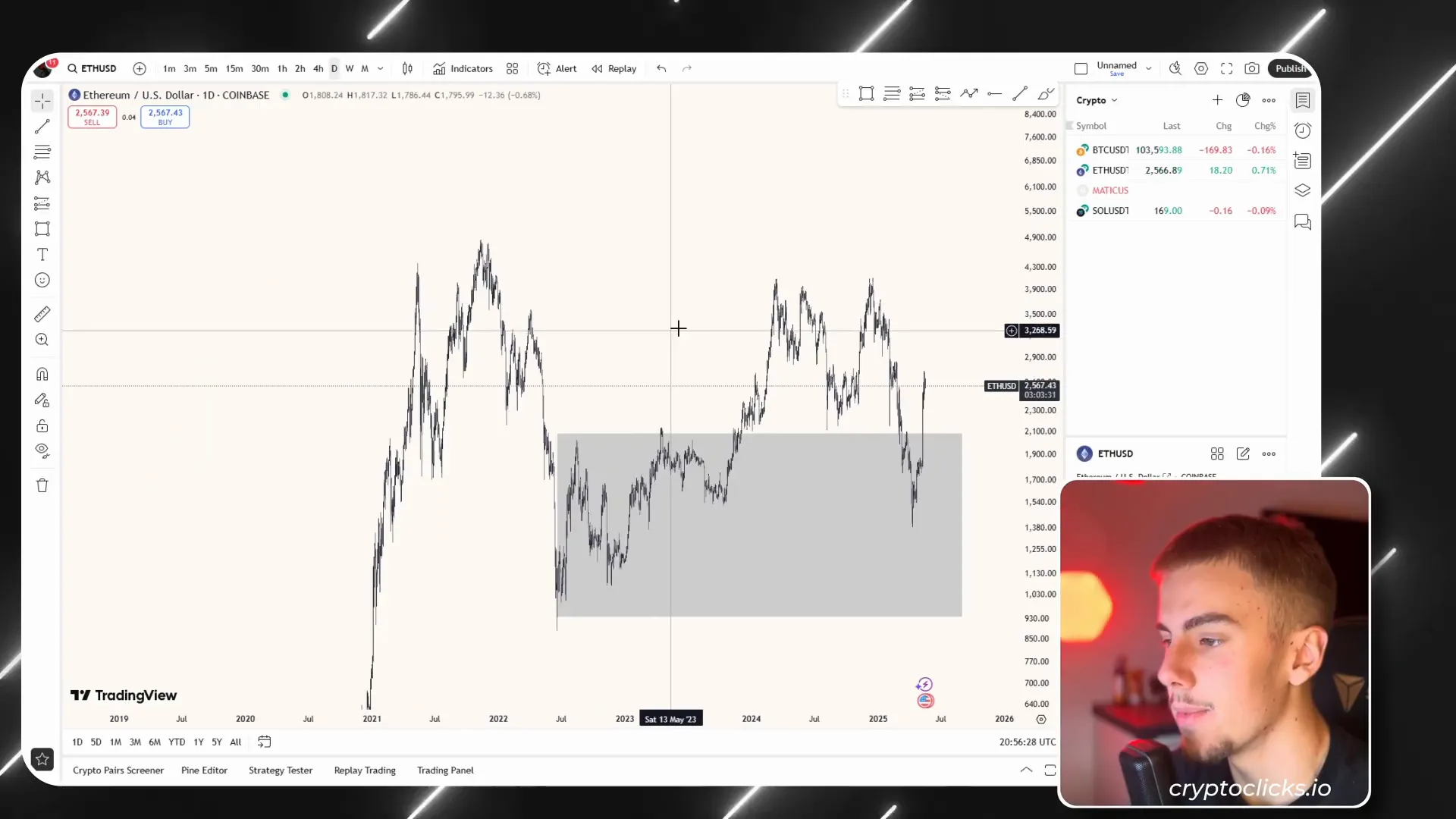

While the long-term outlook is promising, the short-term price action is likely to experience some volatility. After a strong pump, Ethereum’s RSI (Relative Strength Index) indicates it was overbought and is currently stabilizing.

What does this mean for traders and investors?

- A pullback to the $2,200 range is expected, where several demand zones await to be tested and mitigated.

- During this correction, Ethereum may form lower highs and break some short-term support levels, but this is part of the natural market structure.

- Long-term investors can use this pullback as an opportunity to dollar-cost average (DCA) into Ethereum, accumulating more at lower prices.

My personal strategy is to buy Ethereum as it pulls back to these demand zones and shows signs of bullish reversal. Staying patient and disciplined during these phases will be key to maximizing gains.

For those looking to dive deeper into Ethereum’s technicals and market behavior, visit CryptoClick’s website for expert analysis and trading insights.

Final Thoughts: Why Ethereum Should Be Part of Your Portfolio

Ethereum remains a dominant force in the crypto ecosystem despite the skeptics and market fluctuations. Its critical role in Web3, NFTs, DeFi, and Layer 2 technologies makes it an irreplaceable asset for the future of finance and the internet.

Remember:

- Ethereum is currently undervalued compared to its potential.

- The crypto cycle suggests a strong bull run is ahead, with Ethereum poised to outperform.

- Short-term volatility is natural, but long-term holders stand to benefit significantly.

If you don’t own Ethereum yet, now is a great time to start building your position before prices reach $7,000 and beyond. Don’t let short-term dips scare you off—dollar-cost averaging can smooth out entry points and reduce risk.

As always, this is not financial advice. Be sure to do your own research and form your own opinion before making investment decisions.

Thank you for reading this crypto meme review on Ethereum’s price action and future prospects. For more detailed analysis, updates, and community discussions, visit CryptoClick’s official platform. Stay informed, stay ahead, and happy investing!