Jun 21, 2025

Ethereum Price: Why the Pump Is Just Getting Started – Insights from Crypto Clicks

If you’ve been following the crypto space, you’ve probably heard a lot of chatter about Ethereum’s recent price surge and what it means for investors. Ethereum has gone through a rollercoaster of opinions—from being declared “dead” and destined to fall below $600, to now rallying impressively and drawing renewed interest. In this article, inspired by insights from Crypto Christopher and the Crypto Clicks community, we’ll break down why Ethereum is pumping, what’s fueling this momentum, and why it might be one of the best long-term bets in crypto right now.

Before diving in, I highly recommend checking out Crypto Clicks’ official website for more in-depth crypto analyses and updates.

Market Overview: What’s Driving Ethereum’s Recent 60% Surge?

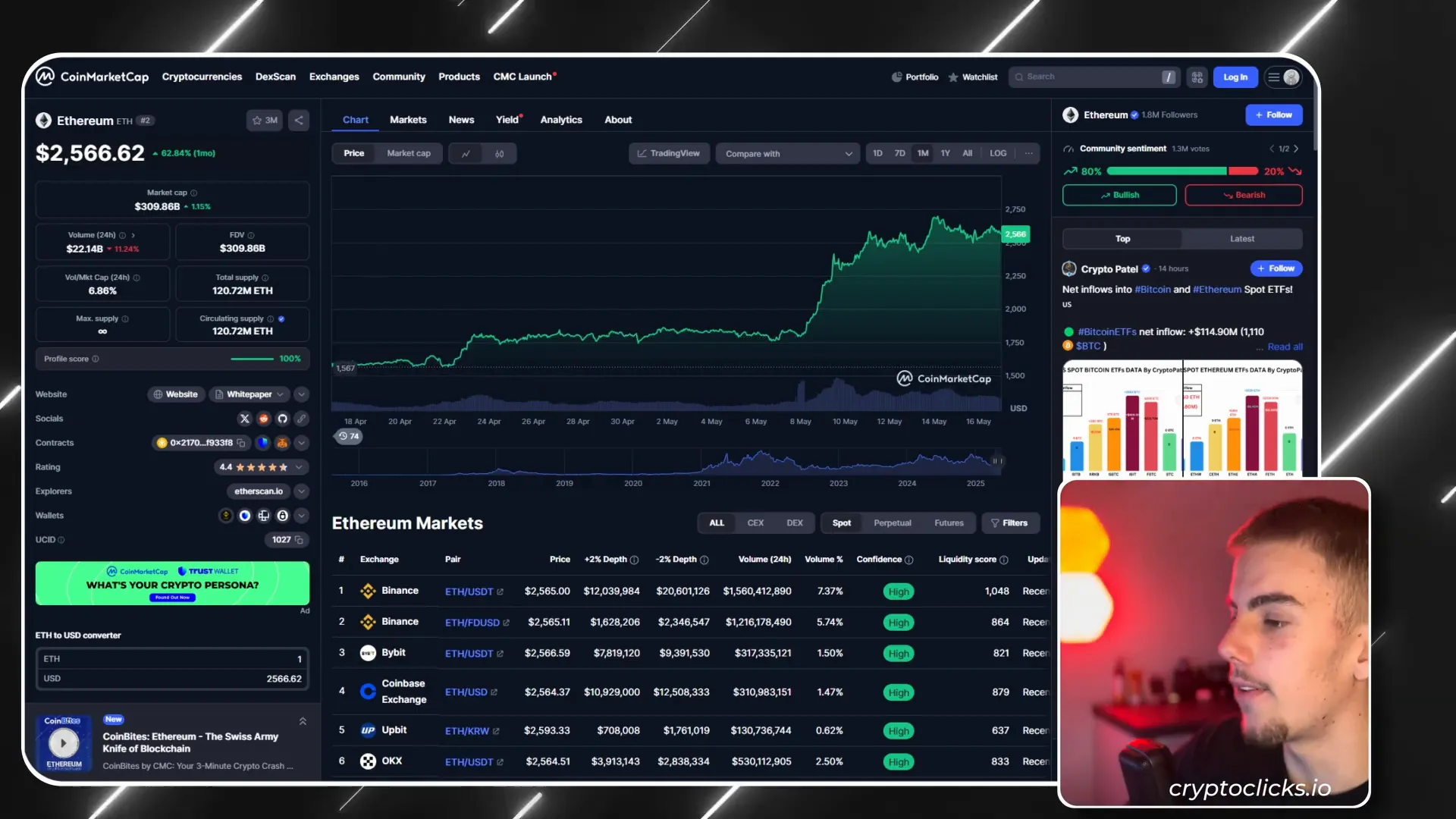

Ethereum’s price jumped from around $1,500 to $2,500 in just one month—a staggering 60% increase that took many by surprise. This sudden pump came despite widespread skepticism just weeks earlier when many predicted Ethereum's value would plummet to $600 or even $500. So, what caused this turnaround?

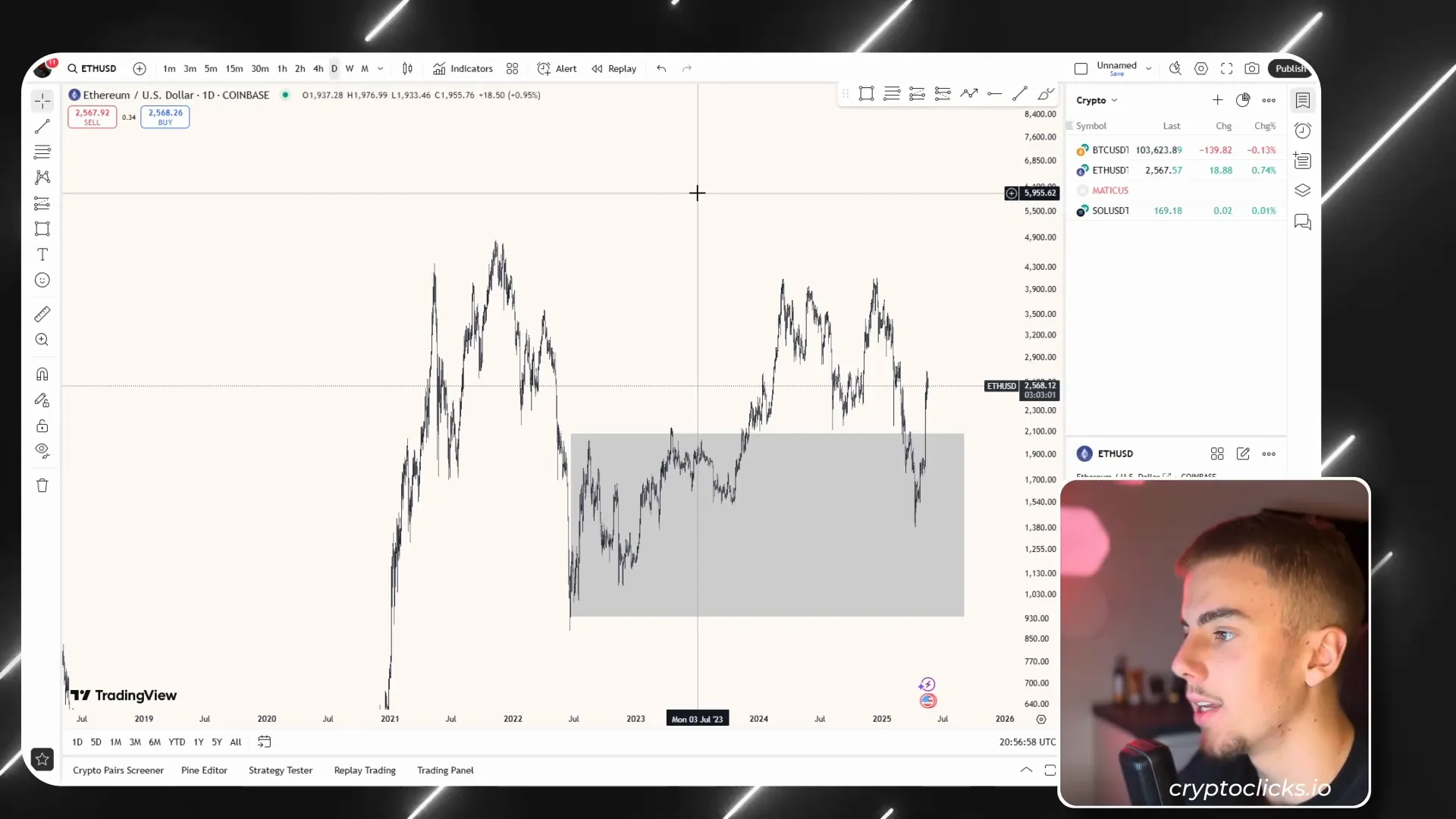

According to Crypto Christopher, Ethereum was actually undervalued for a significant period. If you look at the yearly chart, Ethereum was in a steady decline from its all-time highs, currently down about 12%. Meanwhile, Bitcoin was hitting new all-time highs, leaving Ethereum lagging behind and underpriced relative to the broader market cycle.

This is largely due to the crypto market’s natural cycle. Typically, Bitcoin leads the charge by reaching new highs, followed by a consolidation phase. Only after Bitcoin stabilizes does Ethereum begin its own rally, attracting investors seeking higher risk and reward. This is the phase where Ethereum’s dominance tends to grow, fueling what’s known as “alt season.”

Institutional Interest and Key Upgrades

The recent pump wasn’t random—it was driven by several critical factors:

- Approval and launch of Ethereum ETFs, which opened the door for institutional money to flow in.

- The highly anticipated “Spectra” update, a major upgrade to the Ethereum network boosting its scalability and efficiency.

- Growing public and institutional recognition that Ethereum was undervalued and a bargain at current prices.

All these elements combined created a perfect storm that pushed Ethereum’s price sharply upward.

Ethereum Price Forecast: Why $6,000 and Beyond Is Within Reach

Looking ahead, Crypto Christopher confidently predicts Ethereum will reach at least $6,000 by the end of 2025. Here’s why this target is not only plausible but conservative:

- Breaking the All-Time High: Ethereum’s previous high was about $4,800. For the current bull run to be valid, Ethereum must break this level, which is expected as the crypto cycle progresses.

- Web3 Powerhouse: Ethereum remains the backbone of Web3 technologies, powering NFTs, DeFi applications, and Layer 2 scaling solutions. This ecosystem growth drives long-term demand.

- Institutional Backing: With Ethereum ETFs approved and institutional investors entering the market, significant capital inflows are expected, similar to Bitcoin's ETF-driven rallies.

Some analysts are even more optimistic, suggesting Ethereum could hit $7,000 or more in the near future. By 2030, a price of $10,000 per ETH is within the realm of possibility if adoption trends continue.

For investors, this means now is an ideal entry point. Ethereum is trading at a “discounted” price of around $2,500, offering a highly attractive risk-to-reward ratio. Whether you’re a seasoned trader or new to crypto, Crypto Clicks encourages considering Ethereum as a core holding for your portfolio.

To explore more about Ethereum’s potential and other crypto insights, visit the Crypto Clicks website for expert analysis and timely updates.

Short-Term Outlook: Expect Volatility and Pullbacks

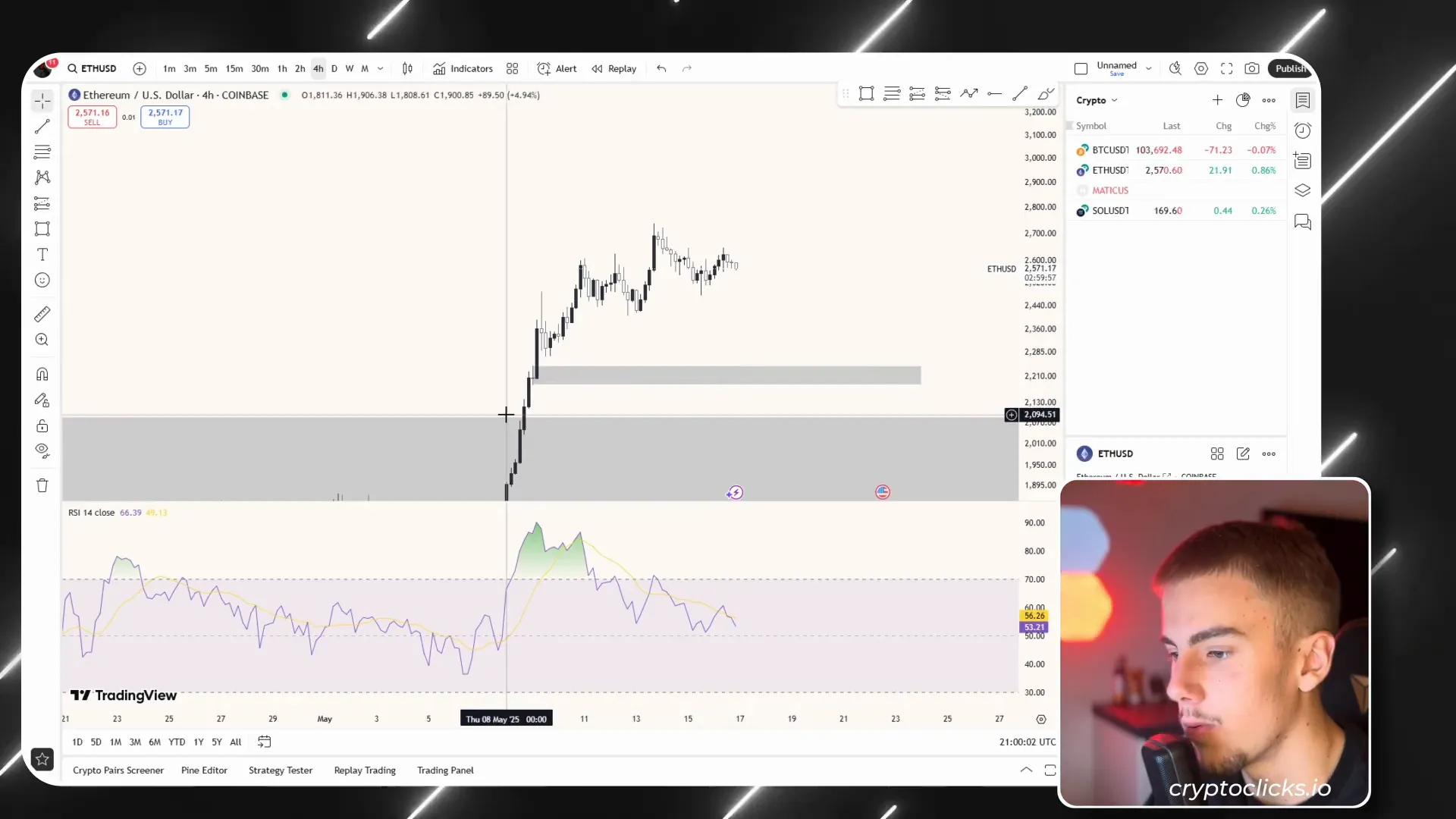

While the long-term picture looks promising, the short-term price action for Ethereum is likely to be more volatile. After a rapid pump, it’s natural to see some corrections and consolidation.

Technical indicators, such as the Relative Strength Index (RSI), show Ethereum was overbought and is now beginning to stabilize and potentially pull back. Crypto Christopher anticipates a short-term bearish phase where prices may dip toward $2,200 to $2,100—key demand zones that have yet to be fully tested.

This pullback is not a cause for panic but an opportunity. The strategy recommended is to dollar-cost average (DCA) into Ethereum during these dips, building a position gradually rather than chasing highs. This approach aligns with the long-term bullish thesis and helps mitigate short-term volatility risks.

Forming Demand Zones and Price Structure

As Ethereum price tests these lower zones, it is expected to form new support levels or demand zones. Once these zones are firmly established and the price begins to break higher structures, it could signal the start of the next bullish phase.

For investors, watching these zones closely and buying during pullbacks can maximize gains and reduce downside risk.

Conclusion: Why Ethereum Is a Must-Watch Asset in 2024 and Beyond

Ethereum’s current rally is more than just a short-term pump. It’s the early stage of a larger crypto cycle that promises substantial upside. With institutional interest, network upgrades, and the growing dominance of Web3 technologies, Ethereum stands as a foundational asset in the crypto space.

If you haven’t already, consider adding Ethereum to your portfolio. The price is currently favorable, and waiting too long might mean missing out on the next big move toward $6,000, $7,000, or even $10,000 in the coming years.

Remember, investing in crypto carries risks, so always do your own research and consider your risk tolerance. But as many in the Crypto Clicks community agree, Ethereum’s fundamentals make it a compelling long-term hold.

For more expert crypto insights, news, and strategies, visit the Crypto Clicks official website and join the conversation with other savvy investors.