Jun 23, 2025

OctaFX vs PU Prime: The Ultimate Meta Trader 5 Broker Showdown

If you’re diving into the world of online trading and wondering which broker to choose, you’re not alone. With so many options, it can be tough to decide. Today, we’re breaking down two of my favorite brokers—OctaFX and PU Prime—to find out which platform truly excels, especially when it comes to trading on Meta Trader 5. Whether you’re a beginner or a seasoned trader, understanding the nuances of spreads, leverage, trading instruments, and copy trading features can help you make the best choice for your trading journey.

Before we get started, if you want to explore PU Prime’s platform yourself, you can sign up here: PU Prime Website.

Broker Website and User Experience

First impressions matter, and both PU Prime and OctaFX deliver clean, modern, and easy-to-navigate websites. When you visit PU Prime, you’re greeted with a sleek interface that feels fresh and intuitive—perfect for traders who value a smooth user experience. OctaFX’s site is comparable, offering a straightforward landing page that makes accessing information simple. So, no clear winner here, but it sets the tone for a solid trading experience on both sides.

Low Spreads: A Key Advantage for PU Prime

When it comes to spreads, especially on popular assets like gold, PU Prime really shines. At the time of comparison, PU Prime’s gold spread was an impressively low 0.09, and I’ve personally seen it drop to as little as 0.01—an incredible edge for traders looking to minimize costs.

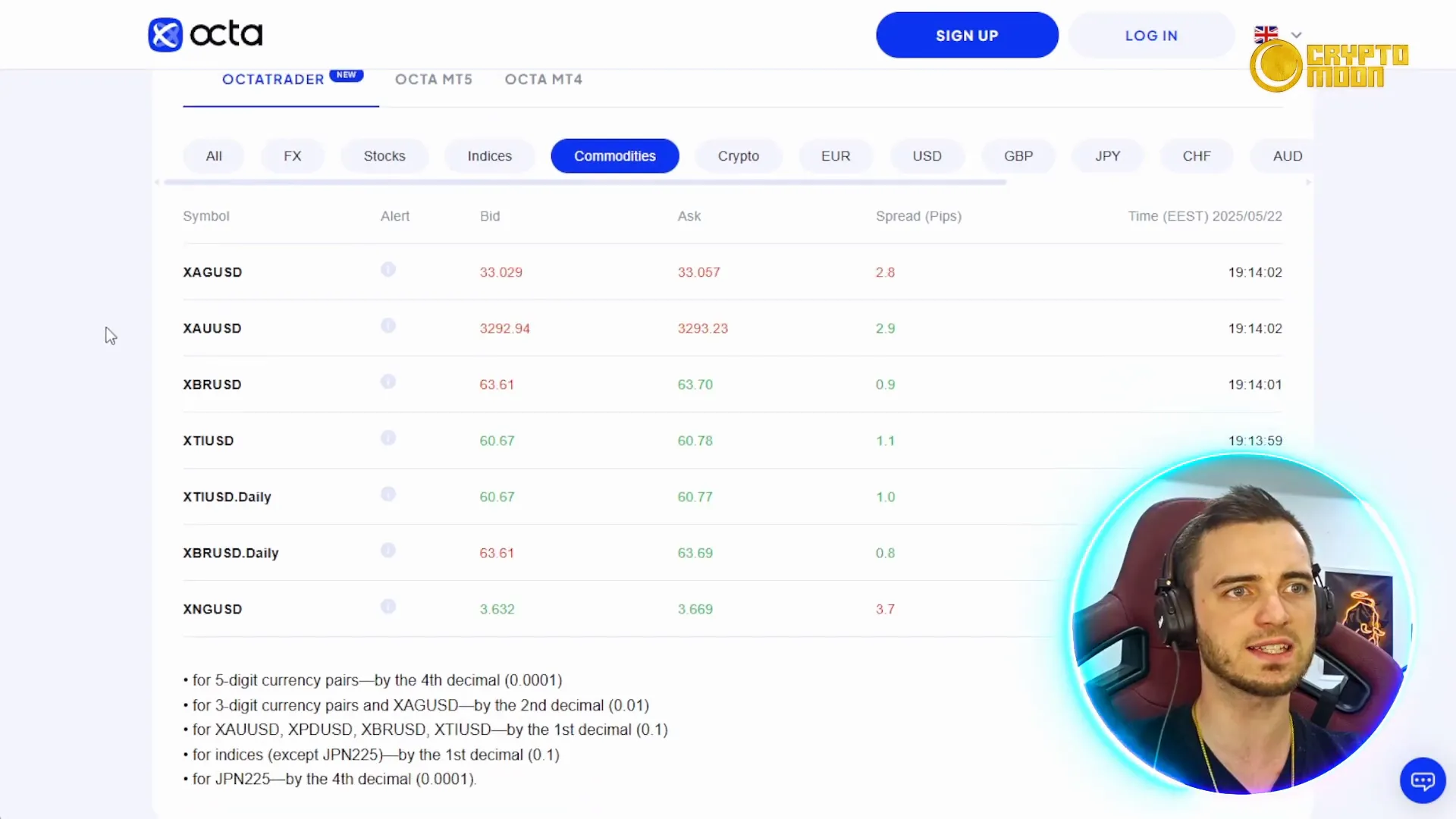

In contrast, OctaFX’s gold spread was significantly wider, hovering between 2.8 and 3. This difference can add up over time, especially for active traders. PU Prime’s tighter spreads give it a clear advantage here, making it a more cost-effective platform for trading precious metals and other assets.

Account Types and Leverage: PU Prime Offers More Flexibility

Another crucial factor is the minimum deposit and leverage options. PU Prime requires a minimum deposit of $50, which is quite reasonable, but the real standout is the leverage—up to 1,000x. This high leverage is especially beneficial for traders with smaller accounts who want to maximize their market exposure without needing a large upfront capital.

OctaFX, on the other hand, has a lower minimum deposit at $25, which is appealing for beginners. However, its leverage varies considerably depending on the asset. For example, stocks offer 40:1 leverage, while forex offers up to 1,000:1. Despite this, PU Prime’s consistent high leverage across most assets makes it more attractive for traders seeking that level of flexibility.

Trading Instruments and Platforms: PU Prime’s Meta Trader 5 and Beyond

OctaFX boasts over 200 trading instruments and supports Meta Trader 4, Meta Trader 5, and their proprietary Octa Trader platform. While this sounds impressive, the actual platform options are limited to three.

PU Prime steps up the game by offering Meta Trader 4 and Meta Trader 5, plus their own trading app, web trading, and an advanced social and copy trading system. The inclusion of Meta Trader 5 is significant, as it remains one of the most powerful and versatile trading platforms available, favored by many for its advanced charting tools and automated trading capabilities.

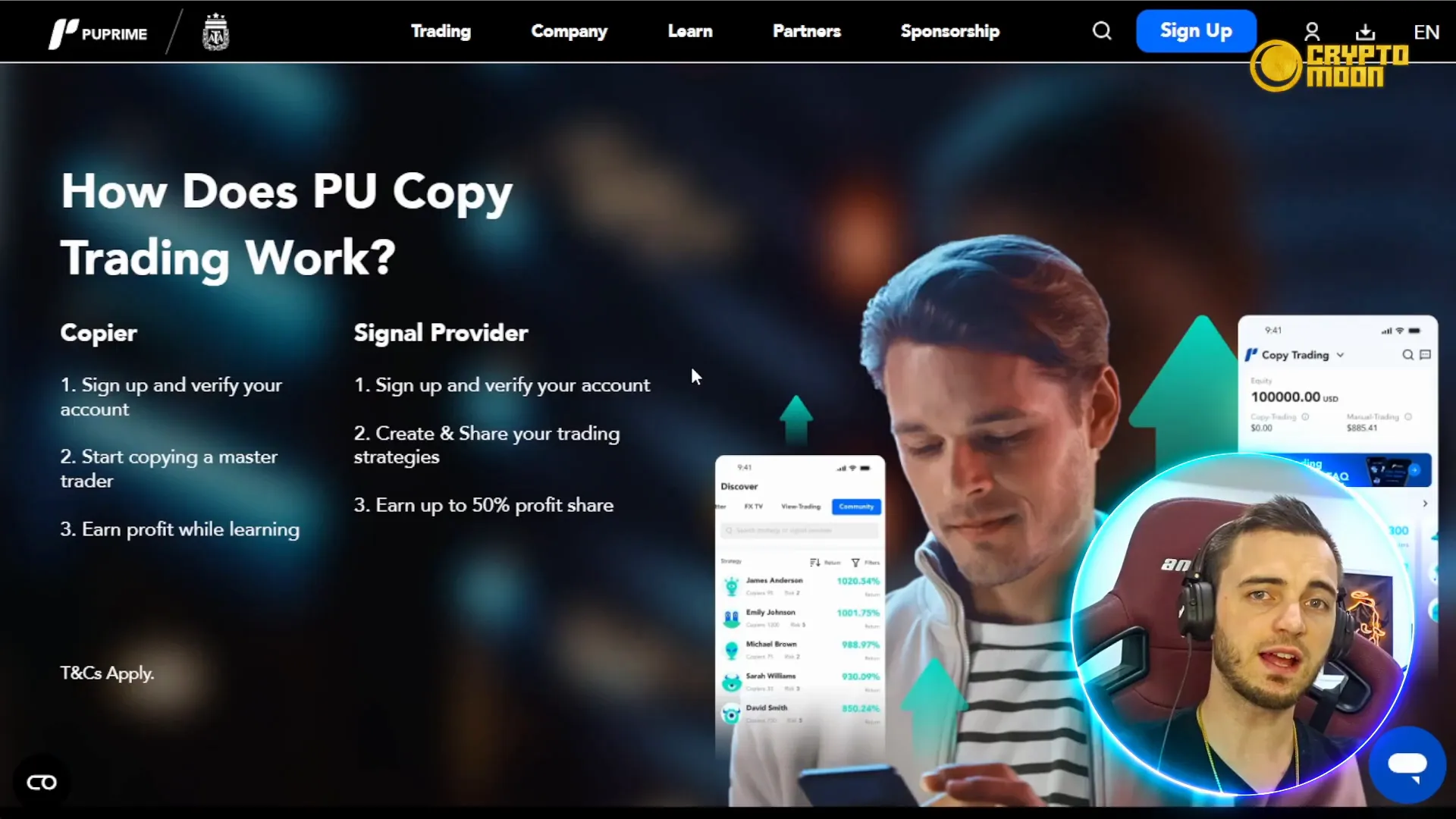

The real highlight here is PU Prime’s copy trading feature, which is a game-changer for both new and experienced traders. With over 150,000 copiers, 6 million successful trades, and 32,000 signal providers, PU Prime dominates this space. Their copy trading system offers multiple modes, higher execution rates, and the flexibility to stop or unfollow traders at any time—all at a lower cost than many competitors.

For those unfamiliar, copy trading works by letting you follow professional traders’ moves. You pick signal providers based on their stats and trading history, invest alongside them, and potentially earn when they earn. It’s a fantastic way to learn and grow your portfolio without having to execute every trade yourself.

If copy trading sounds like something you want to explore, check out the PU Prime Copy Trader App for a seamless experience.

Regulation and Global Accessibility

Safety and regulation are paramount when choosing a broker. Both PU Prime and OctaFX are well-regulated, but PU Prime holds an advantage with its FSA regulation, a top-tier license that allows trading access from over 200 countries. This makes PU Prime particularly appealing for traders who travel frequently or live in regions where some brokers might restrict service.

OctaFX, while regulated, is somewhat more restricted in terms of geographic accessibility, which could limit your flexibility if you move or want to trade from different locations.

Conclusion: Why PU Prime Stands Out

After comparing OctaFX and PU Prime across website usability, spreads, account and leverage options, trading instruments, copy trading capabilities, and regulation, the winner is clear. PU Prime offers a more comprehensive and modern trading experience, especially for those using Meta Trader 5.

Its ultra-low spreads, high leverage, superior copy trading platform, and wider global reach make it an excellent choice for traders at all levels. With my 10 years of experience in trading, I can confidently say PU Prime is the broker to watch and consider for your trading needs.

Ready to take your trading to the next level? Sign up and start trading with PU Prime today: PU Prime Official Website.

Best Forex Broker

Trade Smart, Trade with PU Prime The Best Forex Broker for Your Success! 🌍📊

Start Now