Jun 23, 2025

eToro Copy Trading vs PU Prime: Which Forex Broker Offers the Best Copy Trading Experience?

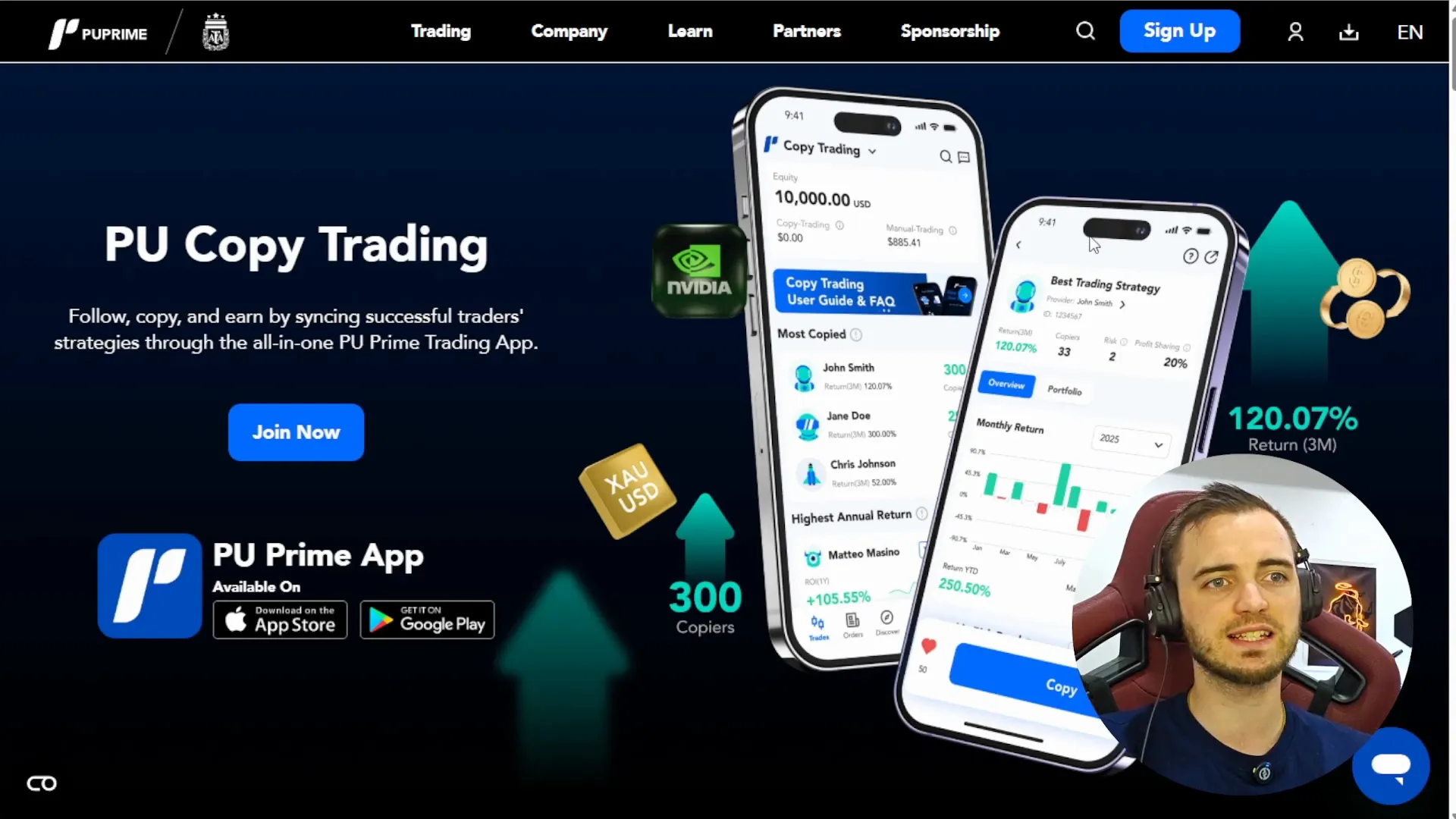

In today’s fast-paced trading world, copy trading has emerged as one of the most effective ways to generate profits in financial markets. If you’re new to the concept, copy trading allows you to follow experienced traders on a platform and replicate their trades automatically. When they enter or exit a trade, you do the same, sharing in their profits and losses. This innovative system, originally popularized by cryptocurrency markets, is now widely adopted by forex brokers, with PU Prime and eToro leading the pack.

In this article, we’ll dive into a detailed comparison between these two forex brokers’ copy trading platforms to help you decide which one suits your trading style best. Whether you are a beginner or an advanced trader, understanding the differences can significantly impact your trading success.

Before we get started, if you’re interested in exploring PU Prime’s platform firsthand, you can sign up here: PU Prime Web Sign Up.

What Is Copy Trading and Why Does It Matter?

Copy trading is a game-changer for many traders who may not have the time or expertise to analyze markets themselves. By following seasoned traders, you can essentially “copy” their moves in real time. The beauty of this system is its simplicity: press follow on a trader, and your account will mirror their trades, allowing you to profit alongside them.

This method is particularly appealing in the forex market, where timing and precision can make all the difference. Choosing the right forex broker with a smooth, reliable copy trading system can elevate your trading journey.

PU Prime vs eToro: A Closer Look at the Platforms

Modern Infrastructure and Speed

PU Prime is a relatively newer forex broker but it leverages modern technology that delivers lightning-fast trade execution, especially during high volume market periods such as market openings and major price moves. From my experience, PU Prime’s system handles congestion better than eToro’s, minimizing delays that can cause slippage and affect your entry and exit points.

On the other hand, eToro, while established and well-known, sometimes experiences slower execution during peak times due to its older infrastructure. If split-second timing is crucial for your strategy, PU Prime’s technology gives it a clear edge.

Regulation and Accessibility

Both brokers are well-regulated, but PU Prime strikes a balance between being secure and accessible. PU Prime is available in over 200 countries, providing a wide reach for traders worldwide. eToro, due to stricter regulatory frameworks in some regions, limits access in certain countries. This makes PU Prime a more flexible choice for traders looking to operate without geographical restrictions.

Leverage Options

Leverage can amplify both profits and risks, so it’s essential to pick a broker that offers suitable leverage levels for your trading style. PU Prime offers leverage up to 1,000x, taking advantage of its less restrictive regulatory environment. This is particularly attractive to traders seeking high-risk, high-reward opportunities.

Conversely, eToro imposes tighter leverage limits, especially in EU countries, where it caps leverage at 30x for copy trading activities. This might be a safer option for conservative traders but limits the potential returns for those who want more aggressive exposure.

User Interface and Ease of Use

When it comes to the user interface, PU Prime stands out with a sophisticated yet intuitive design. Their app and web platforms allow traders to easily analyze potential traders to follow by dissecting their performance metrics. Whether you want to identify the best performers or avoid risky traders, PU Prime’s clear presentation makes decision-making straightforward.

eToro offers a more simplified and retail-focused interface, which is great for beginners. However, this simplicity comes at the expense of flexibility and detailed insights, making PU Prime a better fit for both novice and advanced traders who want more control and transparency.

Minimum Deposit and Copy Trading Flexibility

Starting your copy trading journey should be easy and affordable. PU Prime’s minimum deposit is just $50, making it accessible for newer traders or those wanting to test the waters without committing large sums. eToro’s minimum deposit can be as high as $200, which might be a barrier for some.

PU Prime also offers multiple copy modes, allowing you to customize how you follow other traders. Plus, the ability to stop copying a trader instantly with a simple “unfollow” button provides unmatched flexibility. In contrast, eToro’s process to stop copying someone is less straightforward and can feel restrictive.

Fees and Spreads

Lower fees and tighter spreads directly improve your profitability. PU Prime offers spreads as low as 0.01, significantly reducing trading costs. eToro’s spreads tend to be higher, often around 1.0, which can eat into your returns over time.

Choosing PU Prime means you benefit from reduced costs, faster execution, and a richer feature set—all crucial factors when copy trading.

Check out PU Prime’s platform and their competitive trading conditions here: PU Prime App Download & Sign Up.

Client Testimonials: Why Traders Prefer PU Prime

- Anna M., beginner trader: “I started with PU Prime because of the low minimum deposit and the easy-to-use app. Copying successful traders has helped me gain confidence and consistent profits.”

- James T., experienced forex trader: “The speed of execution on PU Prime is unmatched. When trading volatile currency pairs, every millisecond counts, and PU Prime delivers.”

- Lisa K., international trader: “Being able to access PU Prime from my country without restrictions was a huge plus. Plus, the leverage options gave me more flexibility in managing my trades.”

Conclusion: PU Prime Takes the Lead in Copy Trading

After comparing PU Prime and eToro across multiple dimensions—technology, regulation, leverage, user interface, fees, and flexibility—it’s clear that PU Prime stands out as the superior forex broker for copy trading. Its modern infrastructure ensures fast trade execution, reducing slippage and maximizing profits. The wide accessibility, flexible leverage up to 1,000x, and user-friendly yet powerful interface make it an excellent choice for traders at any level.

While eToro remains a solid option, especially for beginners who prefer a simpler platform, PU Prime’s advantages in fees, flexibility, and execution speed give it the edge in this competitive space.

If you want to experience a top-tier copy trading platform and take your trading to the next level, I highly recommend giving PU Prime a try. You can get started right now by visiting PU Prime’s official website.

Best Forex Broker

Trade Smart, Trade with PU Prime The Best Forex Broker for Your Success! 🌍📊

Start Now