Jun 23, 2025

eToro Copy Trading vs PU Prime: Which Platform Wins for High Keverage Trading?

If you're diving into the world of copy trading and seeking a platform that offers high keverage alongside a seamless user experience, you’ve probably come across PU Prime and eToro as two of the leading contenders. After thorough exploration and testing, PU Prime emerges as a standout choice, especially for traders who want flexibility, speed, and cost efficiency. Whether you're a beginner or an experienced trader, understanding the nuances between these two platforms can make all the difference in your trading success.

For those ready to explore a platform that supports high keverage while providing a robust copy trading experience, you can check out PU Prime here: PU Prime Web Sign Up.

What Is Copy Trading and Why Does It Matter?

Copy trading is revolutionizing how traders engage with financial markets. Essentially, it allows you to follow and replicate the trades of expert traders on a platform. By pressing “follow,” you automatically enter and exit trades in sync with the trader you're copying. This means if the trader profits, you profit as well, without needing to make every trading decision yourself.

This strategy originally gained traction in the cryptocurrency markets but has since been adopted by brokers worldwide. PU Prime and eToro stand out as pioneers in offering copy trading services, yet they differ significantly in features and user experience.

PU Prime vs eToro: Infrastructure and Speed

PU Prime is a relatively newer broker, and this freshness translates to a modern, technologically advanced infrastructure. During high congestion times—like market openings or volatile price movements—PU Prime’s platform performs faster and more reliably than eToro’s, ensuring that your trades execute almost instantly.

On the other hand, eToro, while established and reputable, sometimes experiences slower trade execution in such conditions, which can lead to slippage where you enter or exit trades later than intended, potentially impacting your profits.

Access, Regulation, and Flexibility

Both brokers are well-regulated, but PU Prime strikes a better balance by being well-regulated without being overregulated. This allows access from over 200 countries, making it a flexible option for traders worldwide. eToro, due to stricter regulations in many regions, limits where traders can access its services.

Another key advantage is leverage. While eToro caps leverage at around 30x in some regions (especially the EU), PU Prime offers high keverage options up to 1,000x. This is a game-changer for traders looking to maximize their position sizes and potential returns.

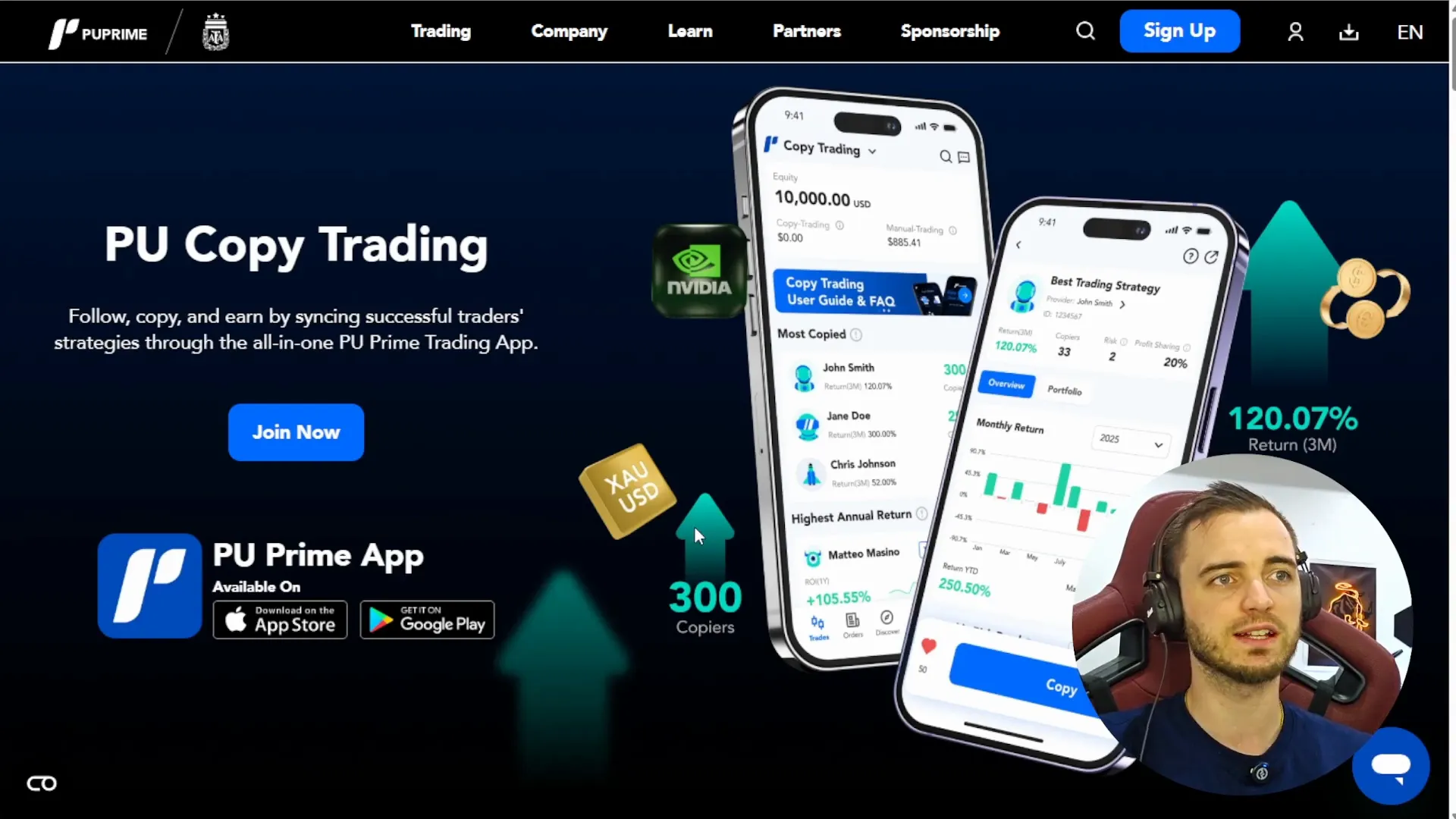

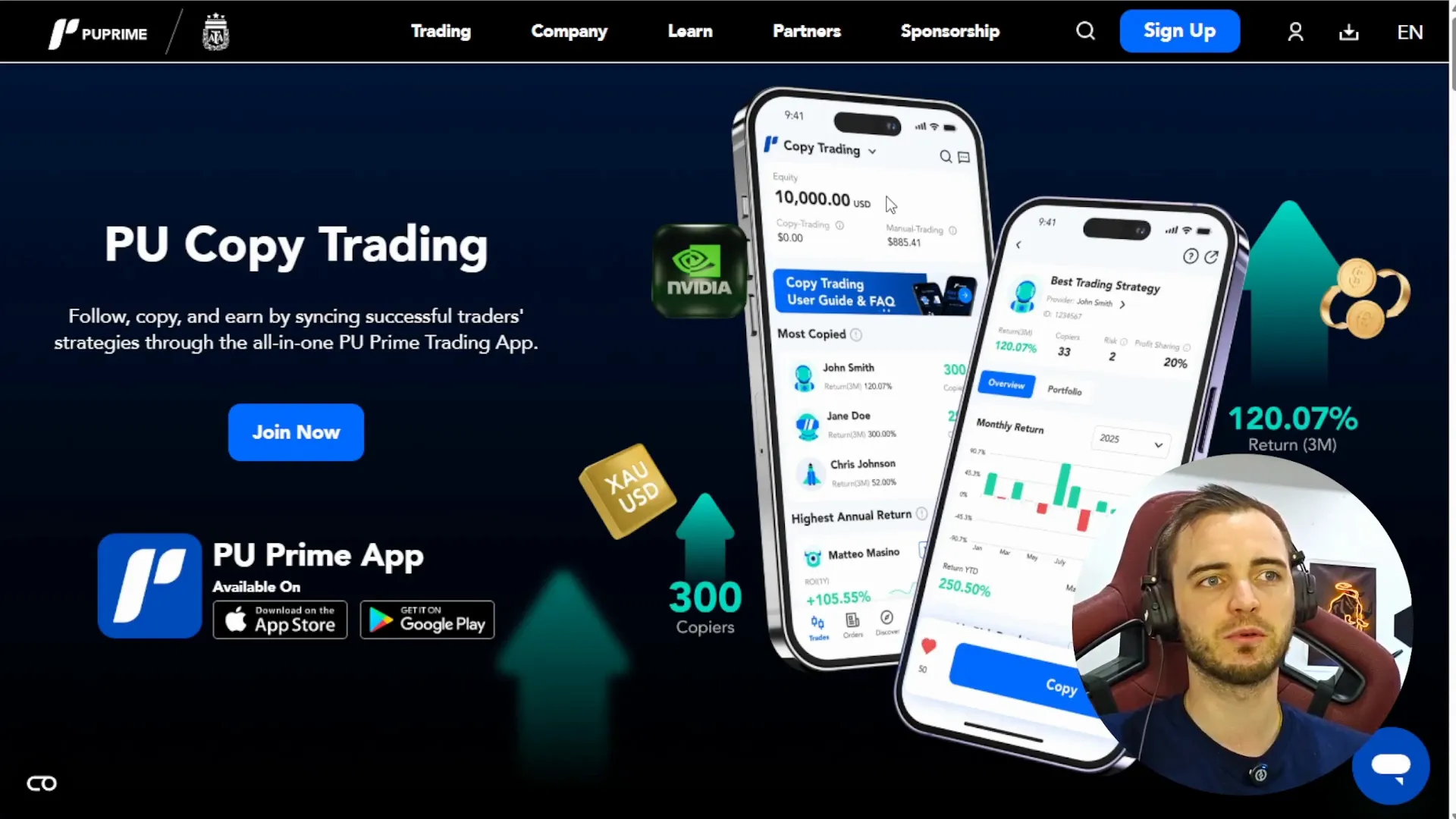

Intuitive User Interface and Copy Trading Features

PU Prime’s user interface is designed to be both intuitive and powerful. The platform offers multiple copy modes, detailed trader analytics, and easy-to-understand stats that help you decide which traders are worth following. Whether you are a novice or an advanced trader, PU Prime lays out all the information clearly and simply.

In contrast, eToro’s interface tends to be more simplified, catering primarily to retail traders. While this makes it easy for beginners, it lacks some of the advanced features and flexibility that PU Prime offers.

Moreover, PU Prime’s minimum deposit is just $50, significantly lower than eToro’s $200 minimum deposit, making it more accessible for new traders who want to start copy trading without a big upfront investment.

Execution, Fees, and Flexibility in Copy Trading

- Execution Speed: PU Prime’s modern infrastructure ensures that trades copy instantly, milliseconds after the original trader acts. This minimizes slippage and helps protect your profits.

- Copying Flexibility: PU Prime allows you to stop copying any trader instantly with a simple “unfollow” button, much like social media platforms. eToro, on the other hand, makes it harder to stop copying, often encouraging you to stay in the trade longer.

- Fees and Spreads: PU Prime offers significantly lower spreads, sometimes as low as 0.01, compared to eToro’s typical 1.0 spread. Lower fees mean better returns on your investments and more efficient copy trading.

These features make PU Prime not just user-friendly but also cost-effective and efficient, which is crucial for anyone serious about copy trading, especially with high keverage positions.

Why PU Prime Stands Out for High Keverage Traders

In summary, PU Prime offers a compelling package for traders who want to leverage the power of copy trading with the advantage of high keverage:

- Flexible access from over 200 countries without heavy regulatory restrictions.

- Leverage up to 1,000x, ideal for maximizing trading potential.

- Modern, fast infrastructure reducing slippage and improving execution speed.

- Intuitive UI with detailed trader stats and multiple copy modes.

- Low minimum deposit of $50, making it accessible for beginners.

- Lower fees and spreads boosting overall profitability.

- Easy-to-use “unfollow” feature for stopping copy trading instantly.

For anyone looking to explore a platform that truly supports high keverage copy trading with all these benefits, PU Prime is definitely worth considering. You can sign up and start your journey here: PU Prime App Download & Sign Up.

Final Thoughts

While eToro remains a solid choice for many traders due to its simplicity and established reputation, PU Prime clearly wins when it comes to advanced features, flexibility, and especially high keverage trading capabilities. Whether you are a beginner or an experienced trader, PU Prime’s modern platform and user-centric design make it a top contender in the copy trading space.

Ready to elevate your copy trading experience with high keverage options? Explore PU Prime today and see how it can transform your trading journey: Join PU Prime Now.

Best Forex Broker

Trade Smart, Trade with PU Prime The Best Forex Broker for Your Success! 🌍📊

Start Now