Jun 21, 2025

eToro Copy Trading vs PU Prime: Which Forex Broker Excels in Copy Trading?

In today’s fast-paced financial markets, one of the most effective ways to generate profits is through copy trading. This innovative approach, which originated in the cryptocurrency markets, has now been embraced by many forex brokers. Among the pioneers leading the charge are PU Prime and eToro—two platforms that offer unique copy trading experiences. But which forex broker truly stands out when it comes to copy trading? Let’s dive in and explore their strengths, weaknesses, and what makes PU Prime a compelling choice for traders of all levels.

Understanding Copy Trading: A Game-Changer for Traders

For those unfamiliar, copy trading is a system where you can follow and replicate the trades of experienced traders on a platform. By pressing “follow,” you automatically enter and exit trades alongside the trader you're copying. This means if they make a profit, so do you—making it an excellent way to learn and potentially earn without needing to analyze the markets yourself.

Both PU Prime and eToro have embraced this concept, but their approaches differ in terms of technology, flexibility, and user experience.

PU Prime: Modern Infrastructure Meets Flexibility

PU Prime, though a relatively newer forex broker, brings a fresh and technologically advanced approach to copy trading. Its modern infrastructure shines particularly during high congestion periods such as market openings or major price moves, where execution speed is critical. Compared to eToro, PU Prime’s platform handles these high-volume times more efficiently, minimizing slippage and ensuring you enter trades almost simultaneously with the trader you’re copying.

One of PU Prime’s standout features is its global accessibility. It is regulated but not overregulated, allowing traders from over 200 countries to join. This contrasts with eToro, which, due to stricter regulations, restricts access in certain regions. For traders seeking flexibility and broader access, PU Prime is a clear winner.

Leverage and Trading Products

Leverage is a crucial factor in trading, especially for those who want to maximize their returns. PU Prime offers leverage up to 1,000x on its copy trading platform, which is exceptionally high compared to eToro’s maximum of 30x in many regions, especially within the EU. This significant difference can greatly impact your trading potential and risk management strategies.

Both brokers provide a variety of trading products and are well regulated, but PU Prime’s slightly lighter regulatory framework translates to greater freedom in how you trade.

User Interface and Trading Experience

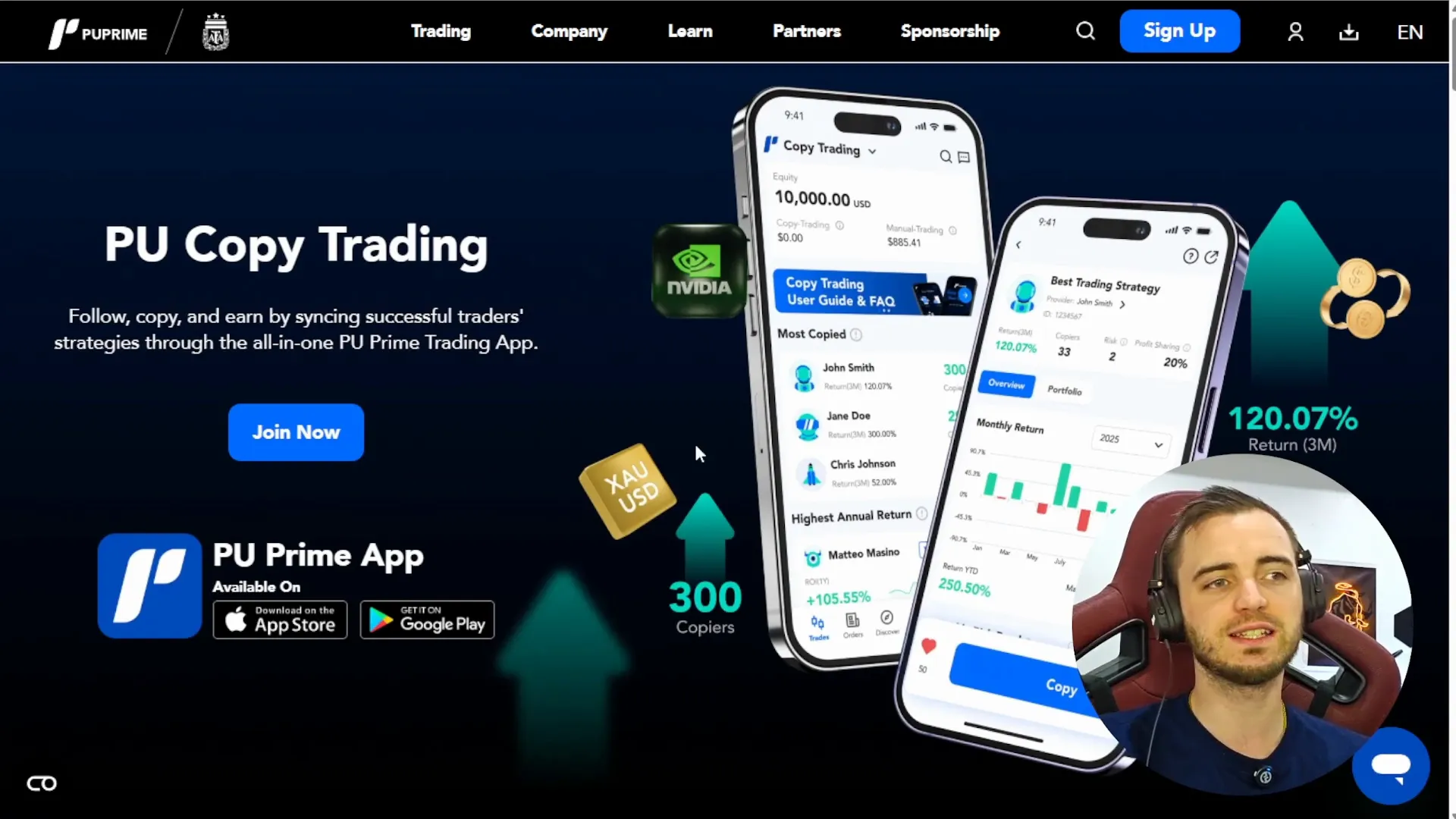

PU Prime’s user interface is designed to be both intuitive and comprehensive. Traders can easily analyze the performance of different signal providers, distinguishing good traders from bad, and make informed decisions on whom to follow. The platform’s app is seamless and user-friendly, catering to both beginners and advanced traders who want detailed insights.

On the other hand, eToro offers a simpler, more retail-focused interface. While it’s easy to use, it lacks the depth and flexibility that PU Prime provides, especially for those looking to customize their copy trading experience.

Accessible Minimum Deposits

For newcomers, the minimum deposit is a key consideration. PU Prime requires only $50 to start copy trading, making it highly accessible for novices or those testing the waters. eToro’s minimum deposit can be as high as $200, which might be a barrier for some traders just beginning their journey.

Why PU Prime Outperforms eToro in Copy Trading

Here’s a quick rundown of why PU Prime stands out in the competitive copy trading space:

- Multiple Copy Modes: PU Prime offers various ways to copy trades, providing more flexibility than eToro’s limited options.

- Lightning-Fast Execution: Trades execute within milliseconds after the copied trader acts, reducing slippage and improving profitability.

- Easy Stop Copying: You can stop copying any trader instantly with a simple “unfollow” button, much like social media platforms. eToro’s process is more cumbersome and less flexible.

- Lower Fees and Spreads: PU Prime offers spreads as low as 0.01, significantly cheaper than eToro’s typical 1.0 spreads, which enhances your return on investment.

These factors combined make PU Prime not just a viable option but a preferred forex broker for traders who want a smooth, efficient, and cost-effective copy trading experience.

Final Thoughts: Which Forex Broker Should You Choose?

While eToro remains a strong platform with a solid reputation, especially for retail traders just starting out, PU Prime offers a more advanced, flexible, and cost-effective copy trading experience. With its modern technology, higher leverage, wider accessibility, and lower fees, PU Prime is well-positioned to win the copy trading battle for many traders.

If you’re ready to explore a forex broker that combines innovation with user-friendly features, PU Prime is definitely worth considering.

Whether you are a beginner or an experienced trader looking to maximize your profits through copy trading, PU Prime’s comprehensive platform provides the tools and flexibility you need to succeed.

Explore PU Prime today and step into the future of copy trading with confidence.

Sign up with PU Prime now and experience the difference for yourself.

Best Forex Broker

Trade Smart, Trade with PU Prime The Best Forex Broker for Your Success! 🌍📊

Start Now