Jun 21, 2025

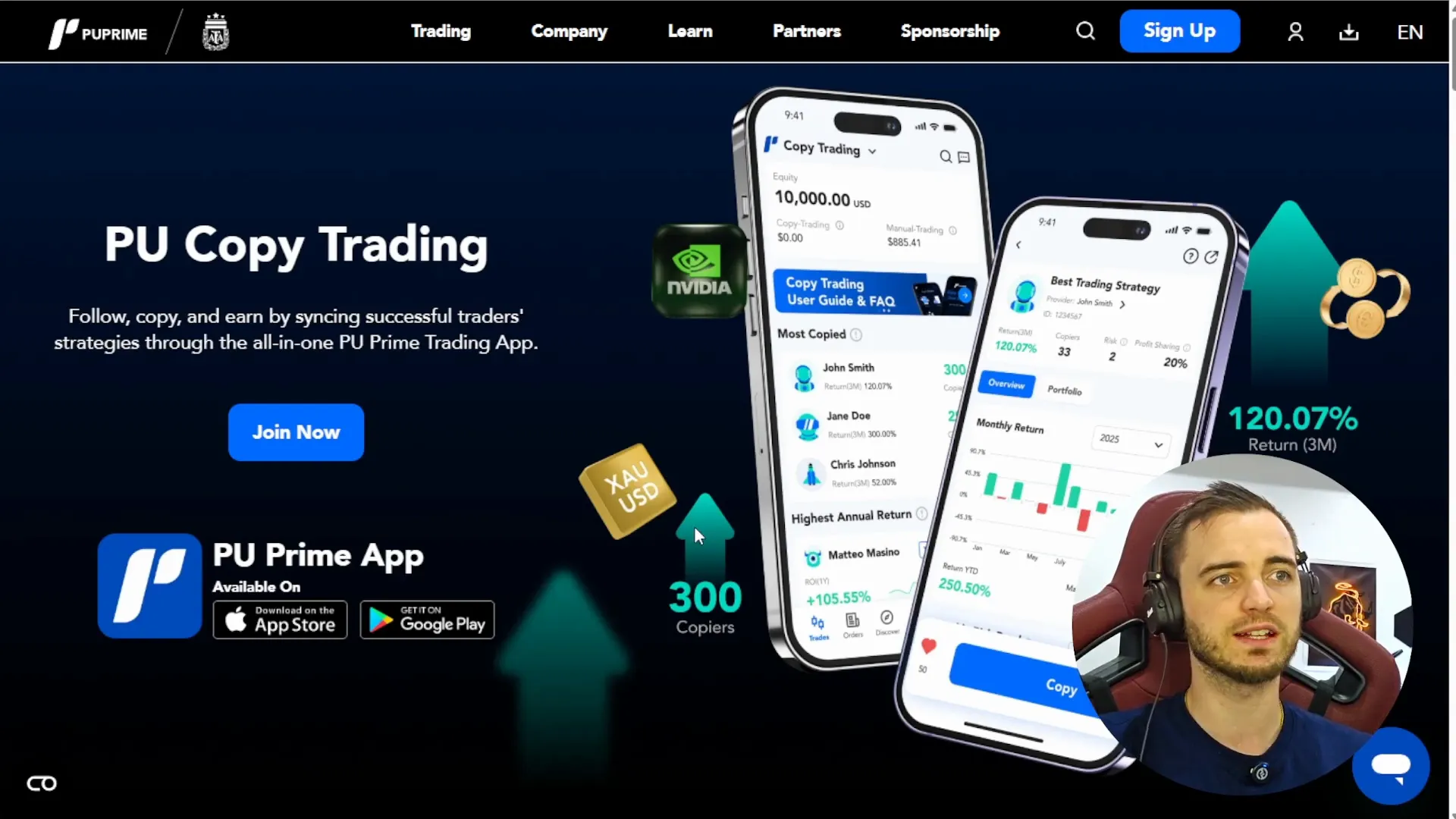

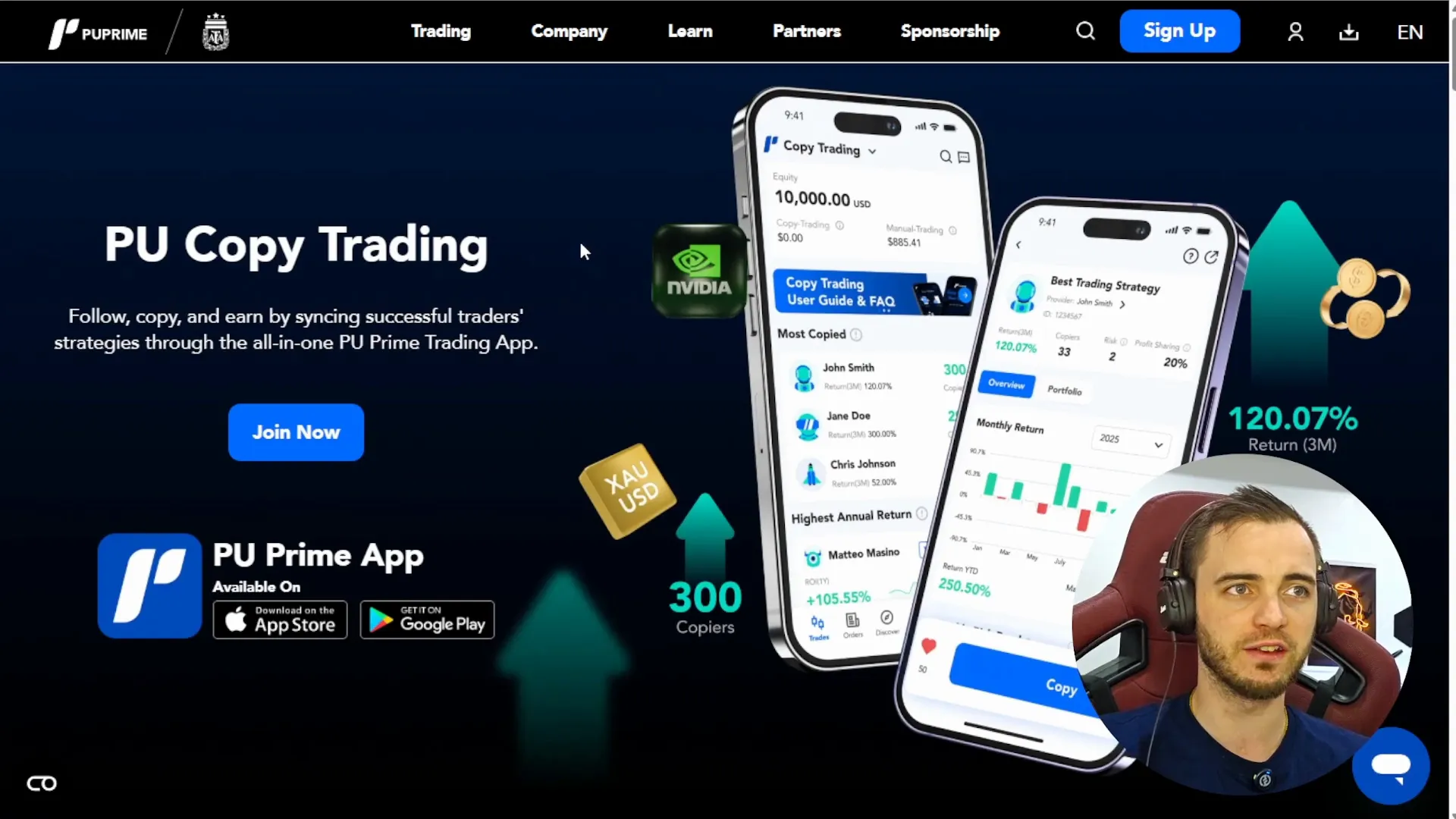

Meta Trader 5 Copy Trading: PU Prime vs eToro – Which Platform Truly Wins?

Copy trading has become one of the most effective ways to make money in today’s markets, especially with the rise of platforms that allow traders to replicate the moves of experienced professionals. If you’re exploring meta trader 5 or similar platforms, understanding the nuances between top brokers like PU Prime and eToro can be a game-changer for your trading success.

In this article, we’ll dive deep into the comparison between PU Prime and eToro’s copy trading systems, highlighting why PU Prime stands out as the preferred choice for both novice and advanced traders. From infrastructure speed to flexible leverage and lower fees, we break down everything you need to know to make an informed decision.

What Is Copy Trading and Why It Matters

Copy trading is a revolutionary system initially popularized by cryptocurrency markets but now widely adopted by brokers globally. Essentially, it allows you to find successful traders on a platform, analyze their statistics, and automatically copy their trades. When the trader enters or exits a trade, your account mirrors those moves in real-time, enabling you to profit alongside them.

This system democratizes trading, making it accessible to those without deep market knowledge or the time to trade actively. Instead, you leverage the expertise of seasoned traders while managing your own risk.

PU Prime vs eToro: Infrastructure and Execution Speed

PU Prime is a relatively newer broker but has quickly gained an edge due to its modern infrastructure and technology. During high congestion times—such as market opens or periods of big moves—PU Prime’s platform executes trades faster and more reliably than eToro. This speed is crucial in copy trading because even milliseconds of delay can cause slippage, impacting your entry and exit prices and ultimately your profits.

In contrast, eToro, despite its long-standing reputation, sometimes experiences slower execution during peak market activity. This can affect your ability to capitalize on rapid market movements when copying trades.

Why Execution Speed Matters in Meta Trader 5 Copy Trading

When using platforms like meta trader 5 for copy trading, the underlying broker’s technology plays a pivotal role. Faster execution means your copied trades align more closely with the original trader’s positions, reducing discrepancies and maximizing potential gains.

Regulation, Accessibility, and Leverage Flexibility

Both PU Prime and eToro are well-regulated brokers, but PU Prime strikes a better balance by not being overregulated. This means PU Prime offers access in over 200 countries, making it highly accessible for traders worldwide. eToro, while highly regulated, faces restrictions in certain regions that limit access.

Leverage is another key differentiator. PU Prime offers extremely flexible leverage options, allowing up to 1,000x leverage on copy trading accounts due to its lighter regulatory framework. On the other hand, eToro imposes stricter leverage limits, especially in the EU where it caps leverage at 30x in many cases.

User Interface and Ease of Use

PU Prime’s user interface is designed to cater to both beginners and advanced traders. The platform allows you to easily analyze traders’ performance, dissect their strategies, and decide who to follow with clarity and transparency. Their mobile app is intuitive, providing a seamless copy trading experience.

eToro’s interface is more simplified and geared toward retail traders who prefer a straightforward approach. While this makes it easier for absolute beginners, it lacks some of the detailed analytical tools that PU Prime offers, which can be a limitation for traders looking to make more informed decisions.

Minimum Deposits and Fees

For those new to copy trading, the minimum deposit can be a deciding factor. PU Prime requires a minimum deposit of just $50, making it accessible for traders who want to start small. eToro’s minimum deposit is generally higher, sometimes around $200, which might be a barrier for beginners.

Fees are another critical consideration. PU Prime offers spreads as low as 0.01, significantly reducing trading costs and improving your return on investment. eToro’s spreads tend to be higher, around 1.0, which can eat into profits over time.

Flexible Copy Trading Features on PU Prime

PU Prime offers multiple copy modes, giving traders more control over how they replicate trades. The execution rate is nearly instant, ensuring you enter and exit trades milliseconds after the trader you’re copying.

Another important advantage is the ability to stop copying a trader at any time with a simple “unfollow” button, similar to social media platforms like X. eToro’s process for stopping copying is more cumbersome, often making it harder to exit copied trades quickly.

Summary: Why PU Prime Wins the Copy Trading Battle

Here’s a quick rundown of why PU Prime stands out as the superior copy trading platform compared to eToro:

- Modern, fast infrastructure minimizing slippage during high-volume trading

- Access from over 200 countries with less restrictive regulation

- Flexible leverage up to 1,000x versus eToro’s capped 30x in many regions

- Intuitive and detailed user interface for both beginners and advanced traders

- Lower minimum deposit of $50 compared to eToro’s $200

- Lower fees with spreads as low as 0.01

- Multiple copy trading modes and easy unfollow/un-copy options

Overall, PU Prime provides a more flexible, cost-effective, and technologically advanced platform for meta trader 5 copy trading enthusiasts. While eToro remains a solid option for beginners who prefer simplicity, PU Prime’s feature set and accessibility make it the clear winner for serious copy traders.

If you’re ready to start or elevate your copy trading journey, consider signing up with PU Prime today and experience the benefits firsthand.

Final Thoughts

Copy trading is reshaping how traders participate in the markets, offering a pathway to profit by following skilled traders. When choosing between PU Prime and eToro, the decision ultimately depends on your trading style, location, and preferences. However, PU Prime’s advantages in infrastructure, flexibility, and cost-efficiency make it the top contender in the meta trader 5 copy trading space.

Explore PU Prime today and take advantage of a platform built to maximize your trading potential with minimal barriers to entry.

Join PU Prime now and unlock the full potential of copy trading.

Best Forex Broker

Trade Smart, Trade with PU Prime The Best Forex Broker for Your Success! 🌍📊

Start Now